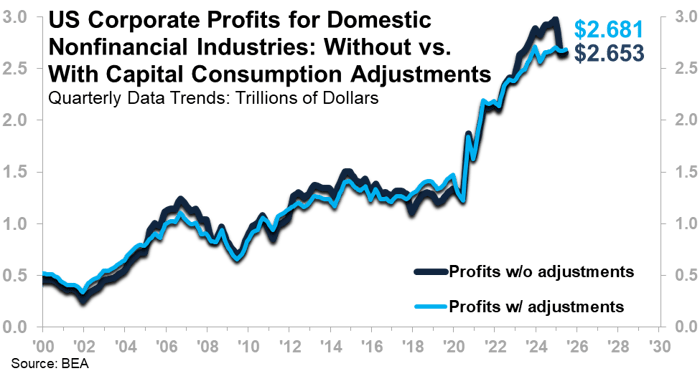

The latest data from the US Bureau of Economic Analysis (BEA) reports that US Corporate Profits for Domestic Nonfinancial Industries have declined to $2.65 trillion in the second quarter of 2025, a 10.8% drop from the December 2024 peak.

However, special tax provisions during certain periods of history can overstate or understate profits. For example, the One Big Beautiful Bill Act (OBBBA) passed earlier this year restored the use of bonus depreciation, a special tax provision that can allow firms to recognize lower profit levels than they would otherwise be able to. The results change significantly if we look at profits after the BEA applies a capital consumption adjustment to account for this issue. Adjusted Nonfinancial Profits came in at $2.68 trillion in the second quarter of 2025, only 1.1% below the late-2023 record high.

A Slowdown In Corporate Profits

Nonetheless, a tick down in Corporate Profits is not unexpected; ITR Economics has been warning of the risk of “profitless prosperity” during the 2020s. This happens when top-line metrics rise thanks in no small part to inflation, but the bottom line suffers as elevated interest rates, elevated labor and material costs, and other pressures impede profitability. While such an environment may call for more careful decision-making, it is not cause for panic. Corporate profits, like the broader economy, move through cycles of accelerating growth, slowing growth, contraction, and recovery. The high-inflation, low-interest-rate, stimulus-driven environment that followed the pandemic likely means that some post-COVID correction is inevitable. Current indicators suggest movements in corporate profits are more of a yellow flag, or a slowdown worth watching, than a harbinger of systemic macroeconomic decline.

- Q3 Earnings – Strong Q3 earnings from Delta Air Lines, Costco, and Nvidia reflect solid consumer demand and optimism around AI. Despite some softness in organic sales and weaker North American volumes, PepsiCo’s Q3 earnings also beat consensus expectations. Many companies are holding ground despite a challenging environment.

- The G7 Leading Indicator – The monthly Indicator is at a more than three-year high as it rises. That implies balanced pressures on global growth, not a sharp contraction.

Industry-level profit trends vary widely, showing that sector positioning matters. Presented below are industry-level corporate profits; keep in mind that we are presenting these profits without capital adjustments, because that is the only industry profit data available from the source. Non-adjusted profits may understate or overstate stated profits during certain periods.

| Industry |

% Change 2Q25 vs. 2Q24 |

Phase |

| Financial |

+13.2% |

C – Slowing Growth |

| Chemical Products |

+7.5% |

B – Accelerating Growth |

| Retail Trade |

+1.1% |

B – Accelerating Growth |

| Information |

-5.2% |

D – Recession |

| Utilities |

-20.6% |

D – Recession |

| Wholesale Trade |

-26.2% |

D – Recession |

| Machinery |

-29.3% |

D – Recession |

Staying Calm Amid the Downturn

A downturn in profits is not a signal for permanent decline. Even after the recent tick down, non-financial corporate profits adjusted for inflation, capital consumption, and inventories are 25.7% above the ten-year average. In addition, corporate profits for many of the sectors in the table above are also elevated relative to historical averages, despite the fact that some of them are in Phase D, Recession (we define Phase D as down year over year, with the pace of contraction intensifying). Based on this, we have the following advice for firms:

- If your profits have dipped, do not panic. Track leading indicators for your industry to distinguish normal market movement from internal issues. If you need help with this, reach out to us.

- Prepare for cost and margin pressure. Strengthen supplier relationships and consider locking in input prices while they are favorable.

- Adopt a growth mindset: downturns often spark innovation and open new markets.

- Secure financing early to capitalize on the next expansion before the 2030s downturn.

Today’s profit softness is a natural reset. Businesses that stay analytical and forward-focused will be best-positioned for the next growth phase. Ensure that you are taking advantage of a slight dip in interest rates to consider what capex projects make sense and which do not as far as combatting profitless prosperity: where the top line rises, but the bottom line remains under pressure. Investment in efficiencies or new markets with a short ROI is the medicine we prescribe for most businesses.