A major condition for economic expansion is the willingness of credit institutions to lend money, and also, the ability of borrowers to service that debt. For the last couple of years, credit conditions have been relatively tight. Commercial banks generally applied more stringent credit standards and loan terms, making it more difficult and more expensive for companies to borrow money to expand their businesses.

Lending Conditions Vs. Financial Conditions Broadly

The latest Federal Reserve’s Senior Loan Officer Opinion Survey (SLOOS) on Bank Lending Practices reports that moderate net shares of banks are tightening their standards for both consumer and business loans; however, the majority of banks surveyed reported that lending conditions were basically unchanged in April of 2025.

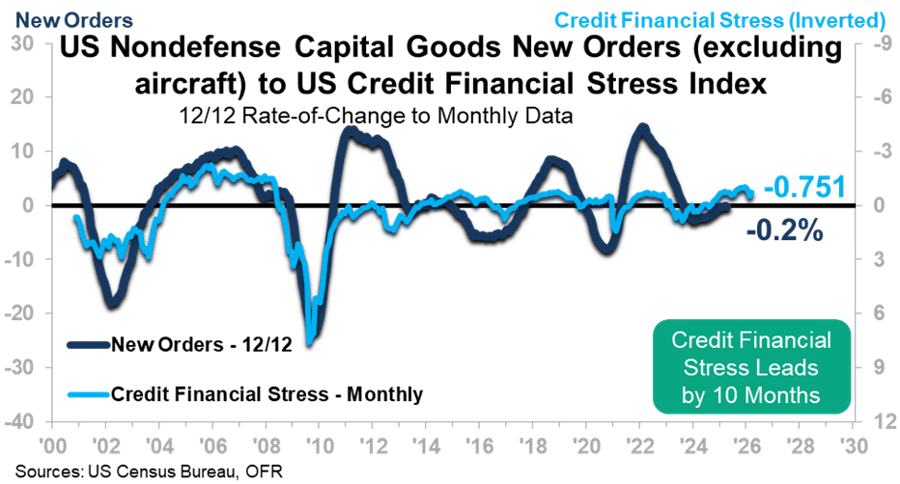

The SLOOS result is based on qualitative survey data specific to lending practices, but we sometimes refer to another leading indicator, the Chicago Fed’s National Financial Conditions Index, to get a broader sense of overall financial conditions. This index includes quantitative inputs not only from the banking system, but also from money markets and equity markets. It has been presenting a slightly more positive picture, signaling a net, modest loosening in financial conditions. Recent results from the US Credit Financial Stress Index suggest that financial stress levels are below average, corroborating the signal from the Chicago Fed’s National Financial Conditions Index.

The chart below shows the US Credit Financial Stress Index with our measure for business-to-business spending, US Nondefense Capital Goods New Orders (excluding aircraft). The Index is inverted in the chart because lower-than-average financial stressors (negative numbers) typically correspond with upside pressure on economic activity. The Index overall provides a modest upward signal for business-to-business spending.

Borrowers also seem to be in a good position to service debts. Both consumer debt levels and corporate debt levels appear to be reasonable: Household debt service as a percent of incomes is on par with the 10-year historical average, while corporate debt levels as a percent of market values are trending below the 10-year historical average.

Economic Consequence

Lending conditions remain tight, but financial stress is relatively low. There may be pockets of opportunity for certain borrowers, but businesses should temper their expectations. Banks tightening commercial and industrial loans cited an uncertain economic outlook and a reduced risk tolerance in the April 2025 SLOOS report. Legislative uncertainty may also be why many banks are holding credit conditions steady rather than loosening them, despite stable financial stress levels.

What early warning signs does the Credit Financial Stress indicator provide for your business? For help assessing the relationship and determining what it means for your future, contact us here! We are always happy to help.