With all the buzz about data revisions in the news, our ears are perking up. We’ve already posted about the jobs data here. However, we want to zoom out and address data revisions more generally now. We know a thing or two about data revisions here at ITR Economics. Here’s what you need to know:

1. Data revisions are normal for many of the datasets forecast and are necessary because of the way the data sources compile their estimates. Some normal reasons for revisions include surveys that are late arrivals, updated data for benchmarks, and seasonal adjustments (though we don’t use much seasonally adjusted data at ITR Economics for analytical reasons). We have decades of experience accounting for likely changes in the data. In our publications, we will commonly share our forecasts as a range rather than just one forward-looking value. This method of displaying the forecast helps account for small shifts in the historical values of the data without requiring a change to the forecast that could disrupt your business planning.

Business planning is also one of the reasons that we publish our accuracy report card with a column for duration. One thing we know is that businesses can’t always pivot on a moment’s notice to account for a change to the data. Data revisions from the source are common with each data release (last few months revised) and on an annual basis (multiple historical years typically revised). We are expecting these changes to the data and accounting for likely changes as best we can in our forecasts. When the data changes significantly enough to warrant a change to the forecast, we will explain that directly in our reports.

Business planning is also one of the reasons that we publish our accuracy report card with a column for duration. One thing we know is that businesses can’t always pivot on a moment’s notice to account for a change to the data. Data revisions from the source are common with each data release (last few months revised) and on an annual basis (multiple historical years typically revised). We are expecting these changes to the data and accounting for likely changes as best we can in our forecasts. When the data changes significantly enough to warrant a change to the forecast, we will explain that directly in our reports.

2. We know how to deal with data changes, and our methodology accounts for the reality that the data is rarely completely set in stone upon publication. Many forecasting methods require a forecast change with each new data release to account for the changes. Our forecasting methods de-emphasize recent data because of the likelihood of change.

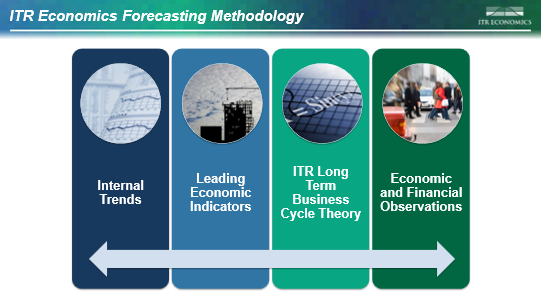

Here are three aspects of our forecast methodology that help protect our clients from large forecast changes due to historical data revisions:

- We know that the recent data is very commonly subject to revision and are considering the likely changes whenever we conduct our analysis.

- We rely on leading indicators, business cycle theory, and our observations to tell us where the market is headed rather than relying exclusively on the recent trajectory of the published data.

- We verify the data by comparing it to data from other sources. When a dataset is not trending with its siblings or cousins, it may be an indication that a data revision is likely to occur soon, and we de-emphasize that data in our behind-the-scenes analysis.

Data revisions are normal, and we will tell you when they are significant enough to impact the analysis for the forecasts we are publishing. We know how to deal with the revisions to give you reasoned forecasts and business insights. However, it is important to note that we are on the lookout for data quality issues due to lower staffing at many of the government agencies responsible for dispensing the data.

We will do what we’ve always done: be skeptical of the data, verify it across multiple sources (whenever possible), and rely on what we know about business cycles as a guide to ensure we are publishing forecasts that you can count on.