The US Index of Consumer Expectations published by the University of Michigan declined for the third straight month in February 2025. The Index is at its lowest level in 14 months. Various surveys show that CEO confidence is also down. There is no big mystery why.

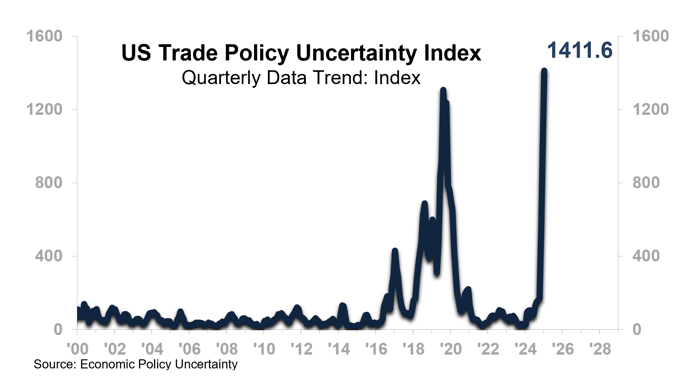

Uncertainty is clearly elevated. Uncertainty is at a record high as measured by the Trade Policy Uncertainty Index (3-month moving average is plotted below). Uncertainty is anathema to normal consumer and business activity. But does that mean there will be a recession in 2025?

The recent decline in Expectations can sound scary, especially when it is accompanied by a rough start to 2025 vis-à-vis the S&P 500. Looking at recent declines in Consumer Expectations reveals that in the three Expectations declines after the Great Recession and pre-COVID, the stock market declined between three to five months. The stock market corrections occurred in 2011, 2015, and 2018. In each of those instances, there was no recession in the US. We expect that will be the case in 2025.

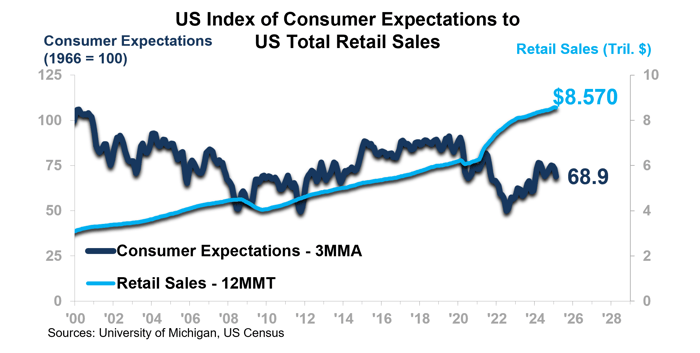

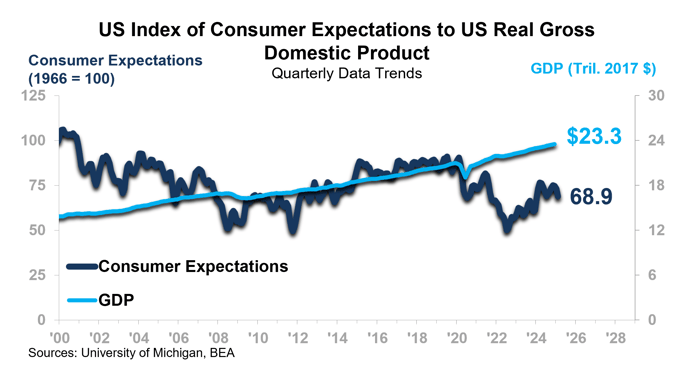

The two charts below compare the Index of Consumer Expectations 3MMA to Retail Sales and then GDP (adjusted for inflation). You will see that Expectations may be down, but that does not mean Retail Sales will be down.

GDP may decline in the first quarter, but that will primarily stem from businesses front-loading imports prior to the tariffs. Imports of Goods in January 2025 were 25.0% higher than January 2024. We will not be surprised if 1Q25 GDP is weak since the way imports are counted will create a drag on GDP, but the economy will recover. Other measures, such as the Dallas Fed’s Weekly Economic Indicator, are not showing the same weakness. Uncertainty will subside in the latter half of 2025. Consumer Expectations will improve along with the stock market.

Tariffs, threatened and real, are creating uncertainty and hence the lack of confidence in consumers and CEOs. We will delve into the topics of supply chains and tariffs and what businesses can do at our March 20 Summit.