We are often asked whether the present “is a good time to buy a home.” The more pragmatic question is whether there will be a better time to purchase a home any time soon.

Affordability is a key factor.

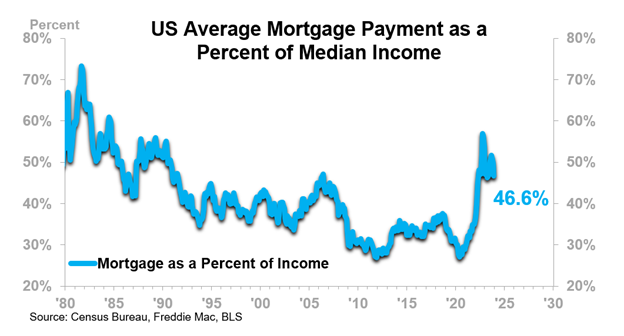

- One of ITR Economics’ in-house affordability metrics, the US Average Mortgage Payment as a Percent of Median Income, has generally declined, moderately, from a late-2022 peak.

- Decline in this metric is a good thing – the lower the share of income being eaten up by a mortgage, the more affordable the home.

- The average payment in December 2023 (the latest data) came in at 46.6% of median income, a figure reminiscent of the mid to late 1980s concerning affordability.

- Even though the current affordability level is an improvement relative to late 2022, it still pales in comparison to the norm that many experienced in the not-so-distant 2010s decade, when the overall average payment was 32.3% of median income (2011 through 2020).

- The percent of income needed in that prior decade was a function of the extremely low cost of money. Today’s 46.6% was normal for the 1980s and it is closing in on the 41.4% of the 1990s.

- Many potential homebuyers are likely wondering whether the conditions of the not-too-distant past are likely to replicate any time soon (spoiler alert: they are not).

The recent moderate improvement in the affordability status is a function of several contributing factors.

- Mortgage rates at the end of February were down 84 basis points (30-Year Conventional Rate Mortgage) from the October 2023 high.

- Home prices have somewhat relaxed. The Median Existing Home Sales Price is down 5.1% from the June 2022 record high. Lower prices are another positive factor for affordability.

- Meanwhile, wages after adjusting for inflation are rising, which is a positive for affordability.

Whether affordability will improve further is dependent on what occurs with these same factors moving forward:

- Mortgage rates – Rates are likely to ease further this year.

- Wages – Given the tight labor market, wages are likely to increase, but trends will vary according to industry, skill level, and geography.

- Home prices – Prices are a little more of a wildcard and are highly dependent on location. However, the recent decrease in home prices is unlikely to persist for too long, as we expect overall inflation to pick up again in 2025 and characterize the rest of this decade.

The Bottom Line

Conditions are not perfect for purchasing a home right now. They may improve somewhat later this year, especially if interest rates are lower as we anticipate. We think an improved time for buying a home may be late 2024 or early 2025. But do not expect a return to the low mortgage rates of the 2010s and through 2021.

- Do your research and assess whether you can buy at today’s level of affordability, or potentially a slightly better level in a year.

- Research and consider regional and city-specific economic and demographic trends.

- Do not overextend. Keep in mind our forecast for an economic depression in the 2030s.