Tariffs are making headlines at the moment, but the fact that we are largely a service-driven economy versus a goods-driven one bodes well for our rise-oriented outlook – particularly for GDP. For more on tariffs, see our blog post published Feb. 3 and watch for the Executive Summary from ITR Chief Economist Brian Beaulieu to be published Feb. 9 in the Trends Report™.

For this post, we will discuss US consumers and businesses, both of which are still acclimating to a new reality: interest rates that are high relative to the borrowing costs of the 2010s.

However, both entities – consumers and businesses – have the means to drive the economy forward.

Businesses

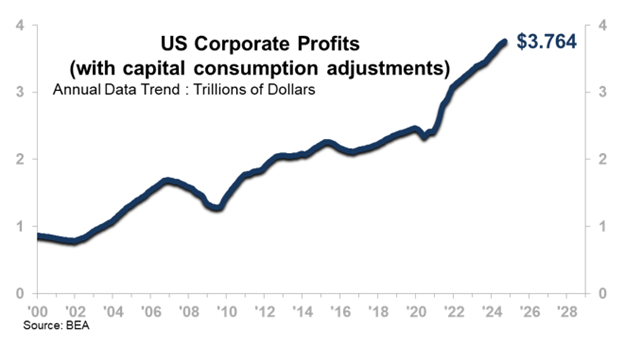

US Corporate Profits (with capital consumption adjustments) are at a record high on a 12-month moving average (12MMA) basis and trending above the pre-COVID trajectory.

The robust Corporate Profits trend is both a signal of current activity and fuel for future activity. High Corporate Profits mean capital goods trends should improve and process improvements will occur.

Consumers

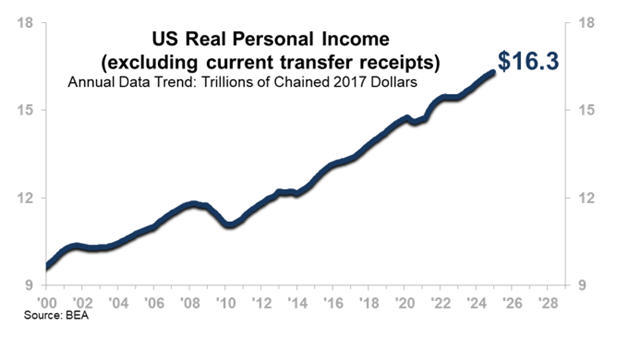

On the consumer side, US Real Personal Income (excluding transfer receipts) is exhibiting a similar record-breaking rising trend, moving in line with the pre-COVID trajectory, and as such the Income trend means more people have more money to buy the goods and services they want.

Real Personal Income data is adjusted for inflation, so when it is rising, purchasing power is outpacing inflation. Consumers are poised to contribute to economic rise. A caveat here is that tariffs can cause sudden price increases on goods, which can at least temporarily impact “spendable income” as consumers adjust to higher prices.

Other Evidence

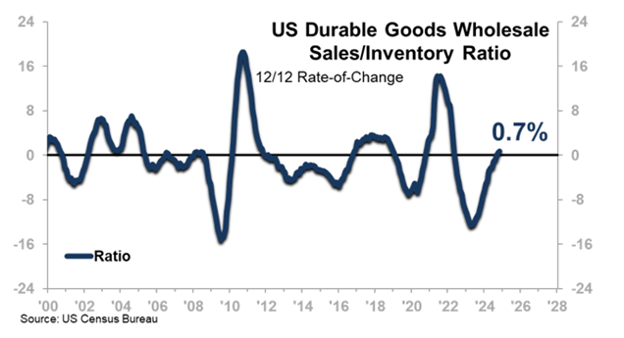

Sales-to-inventory ratios are improving, particularly in the durable goods sector; the US Durable Goods Wholesale Sales-to-Inventory Ratio recently transitioned to Phase B, Accelerating Growth.

We are also seeing nascent improvement in the machinery sector. The US Machinery, Equipment, and Supplies Wholesale Sales-to-Inventory Ratio is still moving in the wrong direction on a 12-month moving average basis, but both the 3/12 rate-of-change and the 12/12 rate-of-change are moving clearly upward, with the former trending above the latter. This is an ITR Checking Point™ that suggests the Phase A, Recovery, trend will persist.

A Profit-Oriented Focus

With industrial rise coming sooner rather than later, and a narrowing window of opportunity before the onset of the 2030s depression, a profit-oriented focus is important.

Identify aspects of your business that are particularly profitable, such as categories of goods or ancillary services you offer, or specific clients you serve, and determine ways to increase the positive momentum. Look to the relationships and endeavors that are already reliably returning a significant ROI and build upon those where possible so you can make the most of the rise ahead.

For the aspects that are not turning a profit for you – if you are not confident that the dynamic will change on short order, consider jettisoning them. That goes for customers and clients, product lines, and your internal initiatives.

If you need help with this, contact us.