How a Proven Methodology Delivers Reliable Insights Through Turbulent Times

In the ever-shifting landscape of global economics, few tools are as crucial for businesses as accurate forecasts. Market volatility, geopolitics, and shifting policy winds can make even the most seasoned strategists question their assumptions. In recent quarters, the eruption of tariff turmoil presented a particularly vexing challenge, introducing new uncertainties into the economic equation. Yet, through it all, ITR Economics demonstrated a steadfast commitment to its proven forecasting methodology, delivering results that underscore the power of rigor, experience, and adaptability.

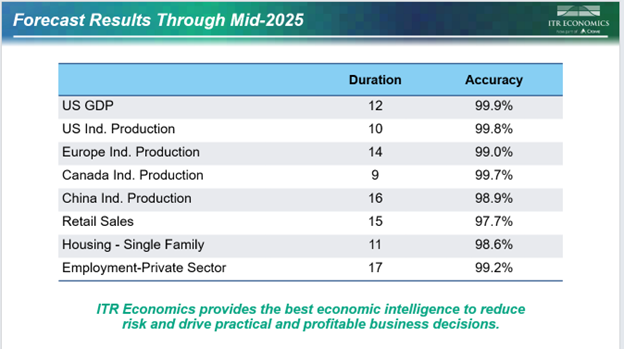

Our approach not only withstood the storm but emerged stronger, providing businesses with a bedrock of reliable insights. Below is the forecast accuracy slide that we include in all our presentations. It has been updated with a mid-year check-in to highlight how our accuracy has held up during the tariff turmoil.

At the very top of the chart you can see that US GDP in the second quarter of 2025 came in within 0.1% of the prediction we made one year ago. This gives us a forecast accuracy of 99.9% 12 months out.

These forecasts were not cherry-picked; these are the same indicators used on this slide in every presentation. We believe in transparency and are more than happy to provide our forecast accuracy for any other series as well.

We aim to balance the longevity and accuracy of our forecasts. We have adjusted some of our forecasts due to recent developments around tariffs and inflation, but the changes were targeted rather than sweeping. We take a data-driven, surgical approach to each macroeconomic indicator, industry, company, or other series we are analyzing. We do not issue blanket forecast changes based on emotion.

When strategizing and planning for the future, you need reliable information, not forecasts that change with every news headline.

Remember that your team and your investors can get caught up in the headlines too. By showing your team the forecasts that ground your decisions — the guiding lights through uncertainty — you strengthen their confidence and inspire commitment to your vision for the firm.

Better days are coming for many industries. Growth is the expected outcome. However, you will need to stay vigilant about your bottom line, as profitless prosperity is an increasing risk for many.