Job openings no longer outnumber job seekers, a trending data point that jolted markets earlier this week.

Investors reacting to the latest Job Openings and Labor Turnover Survey (JOLTS) results fueled demand for Treasurys, pushing yields lower. The ratio reversal of job openings to job seekers marks a significant shift from the red-hot labor market we saw in the wake of the pandemic, when open positions far outstripped available workers.

Look to the Broader Trend for Context

So, what does this really mean for the economy going forward? On the surface, it could suggest the job market is cooling rapidly. This is a notable consideration that many investors speculate will nearly guarantee a Federal Reserve interest rate cut at the next meeting.

But interpreting employment data is tricky. Hiring decisions are typically reactionary, so relying on employment data is like looking in the rearview mirror. It is also important to consider that JOLTS data is released a month after the reference period. Today’s headlines reflect conditions that are already outdated. Investors reacting to JOLTS may be trading on yesterday’s reality.

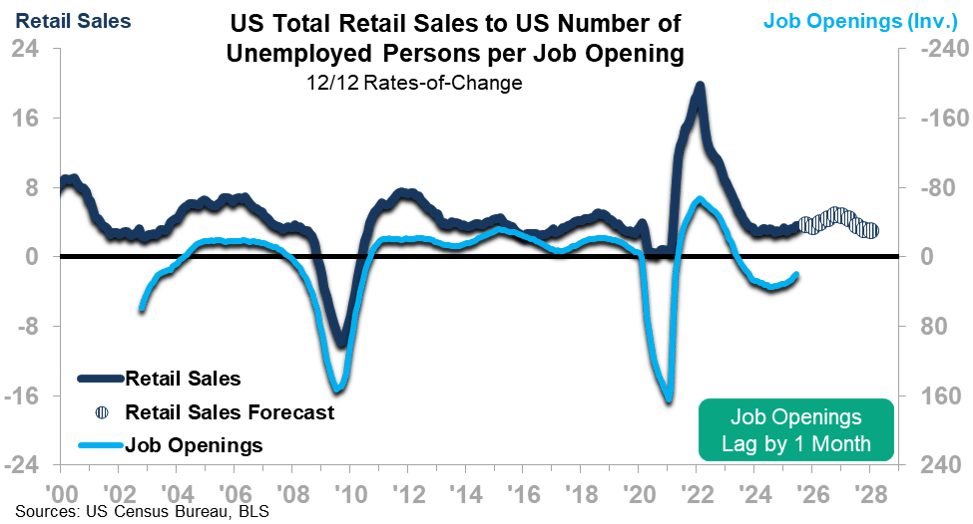

At ITR Economics, we look at the annual rate-of-change to reveal the broader trend, and our analysis confirms that both top-line employment numbers from the Current Employment Statistics survey (CES) and the JOLTS data lag key economic series like US Retail Sales, US Industrial Production, or US Real GDP. If we chart the JOLTS data for the US Number of Unemployed Persons per Job Opening with Retail Sales, we can see that the overall trend reveals that the jobs market is likely on the road to recovery and that Retail Sales are unlikely to drop off a cliff.

Note: We have inverted the US Number of Unemployed Persons per Job Opening 12/12 on the chart above, given that a higher number of unemployed persons corresponds with a weaker consumer market. In other words, as the number of unemployed persons per opening rises, consumer spending typically weakens.

Pockets of Strength and Weakness

That is not to say there are no risks. A lower ratio of job openings to unemployed workers does suggest increased competition for roles, which may have near-term implications for consumer sentiment and discretionary spending.

The datapoint is also likely to be a consideration for upcoming Federal Reserve interest rate decisions, particularly as it draws attention to an uptick in the US Unemployment Rate (coming in at 4.5% in 2025) and calls into question the Fed’s goal of full employment. The results may mean we get a rate cut, and, along with it, potentially increased liquidity in the markets. For ongoing updates, tune in to our weekly Fed Watch episodes.

A Snapshot, Not the Full Picture

Our analysis of the jobs market overall reveals that the labor market has softened, but is far from breaking. We have clear pockets of weakness and clear pockets of strength depending on the industry. Outcomes may differ considerably depending on your target clientele. Overall US Private Employment continues to rise, though at a slowing pace. But beneath the surface, the story diverges: services and leisure remain resilient, while manufacturing and construction show pronounced weakness.

For businesses and investors alike, the key is to treat JOLTS as a snapshot. The real insight comes from leading indicators that depict not where we’ve been, but where we’re going. Ensure you have a solid collection of leading indicators to help you avoid overreacting to headlines.