The economy is exiting a business cycle soft landing. That alone creates confusion and consternation. The lack of well-defined momentum in the economy is evident in the leading indicators, and it is exacerbated by the policy uncertainties many business leaders are feeling. Trying to discern the best path and make the right decisions becomes harder when you are contending with these circumstances.

Are We in a Recession?

Seeing the future and making timely decisions is relatively straightforward when the leading indicators are blasting off. We can tell our clients to expect a similar shift in their business/markets in X months. Sluggishness throws off the timing, and variation of experience makes the situation even worse. Are we in a recession, or are we not? The answer, from a macroeconomic perspective, is that we are not.

GDP (adjusted for inflation) is rising. Ergo, we are not in a recession as classically defined.

Sector-by-Sector Breakdown

The service component of GDP in the second quarter of 2025 came in 1.9% ahead of last year, and additional rise is indicated. The chart below shows that Total Manufacturing has not enjoyed the same growth profile as Services; however, there is positivity in that trend as well. Total Manufacturing in the US for the last three months came in 1.2% higher than a year ago. While 1.2% is not great, it is the most favorable comparison in almost three years.

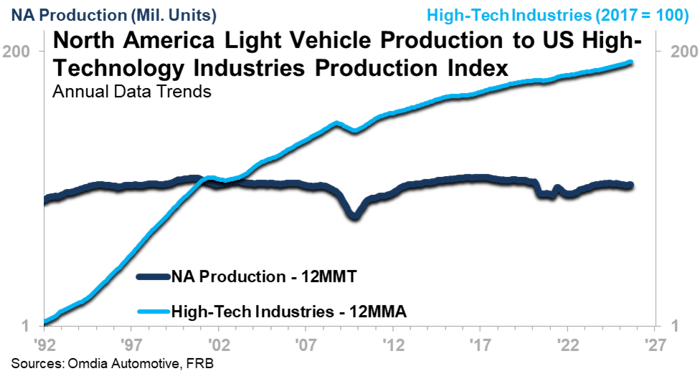

If Total Manufacturing is in such a mild rising trend, it follows that some segments are in negative trends and others are rising. High-Tech Industrial Production is clearly rising, and those in that segment feel relatively good (see chart below). That part of the economy is in growth mode. High-Tech Production for the last three months is up 13.6% from one year earlier, and climbing, and the average for the last months is a record high. If you are dependent upon light vehicle manufacturing in North America, production for the last three months is up 2.0% from the recession level posted last year, and production for the last 12 months is 13.9% below the March 2017 record high.

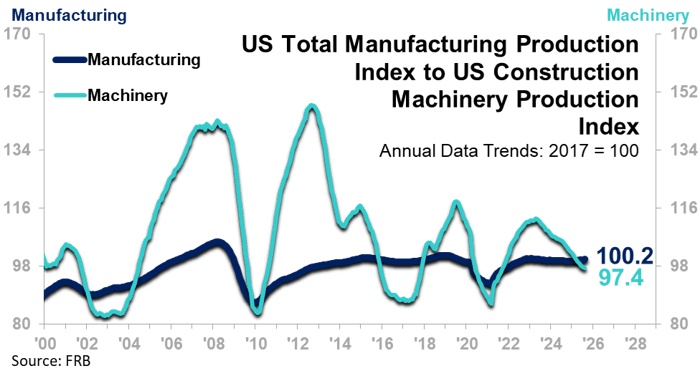

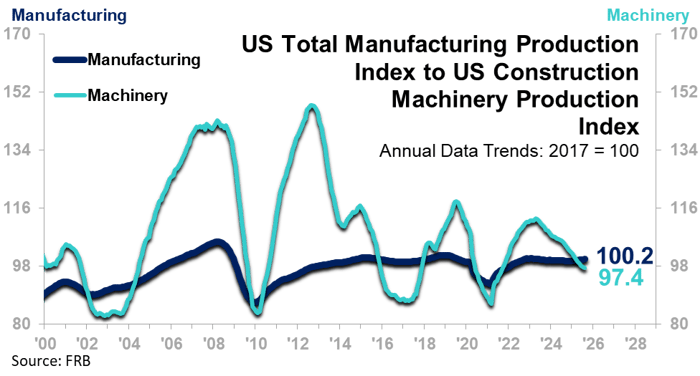

Remember that a soft landing means some sectors prosper while others do not. The next chart provides an example. While Total Manufacturing is edging higher, there is nothing positive about the trend for Construction Machinery Production. The annual average index is down 7.5% from a year ago and 34.2% below the 2012 record high.

Contrast that trend status with Engines and Turbines Production (next chart). The Engines and Turbines annual average index is rising from a 2024 low. It is up 8.5% from a year ago, although it too is in a negative growth posture, running 24.5% below the 2012 high. This marketplace is in recovery mode.

Preparing Your Business for the Next Economic Shift

The title that started all this was “Soft Landing v. Full-Throttle Momentum.” Soft landings are messy, and full-throttle rise is typically well defined. However, beware: Full-throttle decline, such as appears in the middle of most of the above charts related to the Great Recession, means that well-defined status is a broad-based negative that casts a wide net.

Q: What do you do with this insight?

A: Get more focused on what particular market is being discussed, because there is no one-size-fits-all answer.

Q: How do I prepare for the next full-throttle adverse period?

A: Learn which markets will help your firm mitigate the full-throttle decline. That will be the focus our December Executive Series webinar, hosted by Brian Beaulieu and Lauren Saidel-Baker (more details coming soon).

-

- Step 1: Identify the markets with potential for your firm.

- Step 2: Utilize marketing, engineering, and your strategic planning abilities to draft a plan to penetrate those markets.

- Step 3: Realize that time is running out.