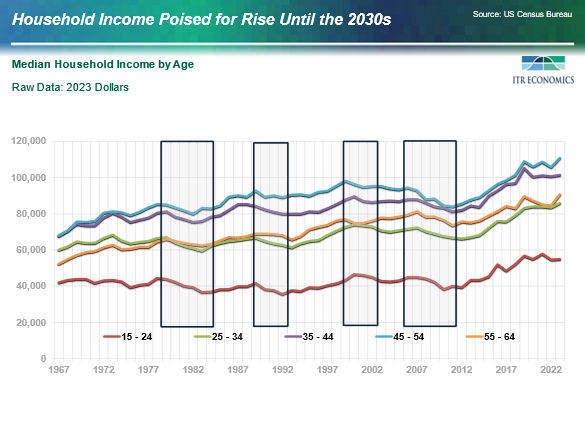

The rise in inflation-adjusted household income stalled in 2022–2023 after appreciably surging going into the COVID-19 pandemic years. Going forward:

- Look for the rising trend to resume in 2025 as the economy heals.

- This trend will be beneficial for firms in the B2C space.

- Beware that discretionary income is shifting.

- Expect income trends across age brackets depicted on the chart to decline in the 2030s.

Look for the Rising Trend To Resume in 2025 as the Economy Heals

It is normal for household income to rise over time, especially when employment is high, unemployment is low, and the labor market is tight. These three conditions will prevail as we enter the post-COVID normalization of the US economy. ITR Economics has shown in various presentations that the ratio of job openings to available people is such that we should expect demand and competition for talent to heat up again as the economy shifts progressively back into a rising trend in 2025. You will be paying more for labor through 2029. Managing that impingement on margin is crucial for profitability over the next five years.

This Trend Will Be Beneficial for Firms in the B2C Space

Rising real incomes mean that it is easier to pass along price increases, be they from general inflation, tariffs, or natural shortages. Easier and easy are two different concepts. But you will in the position of knowing that the consumer is able to afford what you are selling at a higher price as long as you can convince the consumer that what you are selling is what they must have.

Beware That Discretionary Income Is Shifting

Median household income across age groups will be rising. However, the competition for those dollars on an after-tax basis (called discretionary income) was impinged by the persistent rising trend in such after-tax demands for household money, such as rent, insurance, car repair, health care, and other categories that have a strong labor content. If you are paying more for rent, it is relatively difficult to go out to the same restaurant (which also costs more), take the same vacation as usual, and purchase “luxury” items in general.

The impingement of discretionary income will be readily observable within the two lower age brackets (these brackets have the least discretionary income to begin with). The higher brackets, which are making more money, will prove to be more fertile territory in the B2C space, likely through the five-year period.

Expect Income Trends Across Age Brackets Depicted on the Chart to Decline in the 2030s

ITR Economics expects the economy to hit a prolonged declining trend in the 2030s. As shown by the squared-off areas on the chart, inflation-adjusted incomes decline during recessions. The 2030s will be more severe and protracted than a normal recession. Accordingly, the negative market conditions encountered by B2C firms in the 2030s will be more adverse than what has occurred previously. Firms need to strategize how they will contend with these conditions. In preparation, contemplate consumption patterns, savings, relative income levels, and staples versus luxury goods and services.