ITR Economics is forecasting growth in US industrial production through the remainder of the decade, offering businesses the opportunity to expand output and revenues. But capitalizing on this growth will involve facing some profitability hurdles.

Electricity costs are also on the rise, and they are likely to remain a margin pressure for the rest of this decade. For manufacturers and other energy-intensive firms, ignoring this trend could mean falling into “profitless prosperity” — when the topline grows without a commensurate increase in profits.

Why Electricity Costs Are Rising

The US Consumer Price Index for Electricity is up 6.2% in the 12 months through August, the fastest pace of growth in 27 months and nearly six times the pre-COVID ten-year average. This climb in electricity costs reflects structural shifts in both demand and supply:

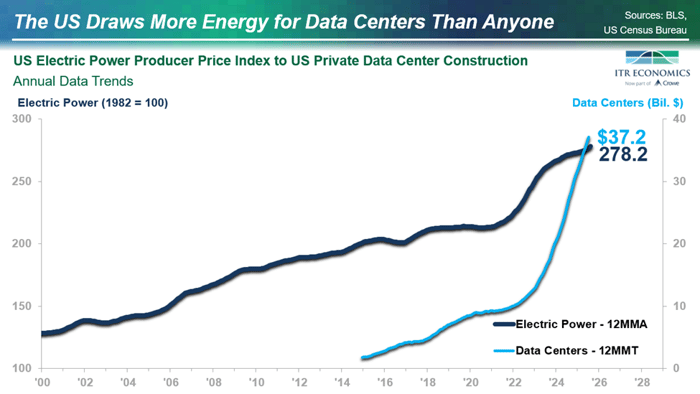

- Soaring demand from technology infrastructure: Data centers, AI computing, and technologies such as cloud services require enormous amounts of electricity. As these sectors scale up, they compete directly with industry for power.

- Rising demand from increasing industrial activity: We expect general industrial growth in the coming years. Corporate profits are near record highs and cash positions are strong. Investments made in nearshoring in the wake of COVID-related supply chain issues will enable increasing production.

- Grid constraints: Much of the US grid infrastructure is decades old and will require funding for repairs vis-à-vis increased utility rates.

The above factors suggest that rising electricity costs are not a short-term phenomenon but likely a defining feature of the business environment for the rest of the 2020s.

Considerations for Businesses

Businesses can take various actions to combat electricity costs. Some will require investment. Such options include:

Efficiency Upgrades

- Upgrade motors, drives, and HVAC systems to efficient models.

- Fix compressed air systems, which are often a hidden energy drain.

- Maintain equipment — leaks, clogged filters, and worn parts drive up costs.

Onsite Generation

- Install solar plus storage to reduce peak demand.

- Maintain backup generation to reduce reliance on volatile grid prices.

To Wait or Not To Wait

Yes, the Federal Reserve recently lowered the fed funds rate and indicated that further cuts were likely. However, our analysis suggests that this is unlikely to lead to significant easing in the longer-term interest rates applicable to capital investment. Therefore, waiting for better terms is unlikely to bear significant fruit; further, any interest rate relief needs to be juxtaposed with the potential costs of delayed ROI, increased pricing as inflation rises, and other factors.

Not all electricity cost-saving options require capital investments. Other options include:

- Shifting heavy processes to off-peak hours to avoid peak pricing.

- Negotiating fixed-rate contracts. We have seen clients have some success with this option.

- Reconfiguring production processes or using less busy periods for staff training to increase efficiency without increasing overhead or variable costs

It is important to note that electricity will not be the only rising costs businesses will likely face in the coming years. Concerns about electrical power costs will need to be balanced against concerns about human power costs, as ITR Economics projects that labor costs will increase by significantly more than is typical over the course of the next three years.

If you need help ranking such concerns or would like a more tailored look at the pricing pressures you are likely to face in the coming years, we are here to help.