Housing costs are still elevated, but some metrics suggest easing mortgage burdens. What do we expect from buyers and builders?

These are some of the latest trends impacting housing affordability:

- Inflation-adjusted earnings are rising.

- Most indicators report that the rate of rise for median single-family home prices is in the low- to mid-single digits

- Mortgage rates have come down slightly, with 30-year fixed rates waffling mostly in the range of 6.6% to 7.0%.

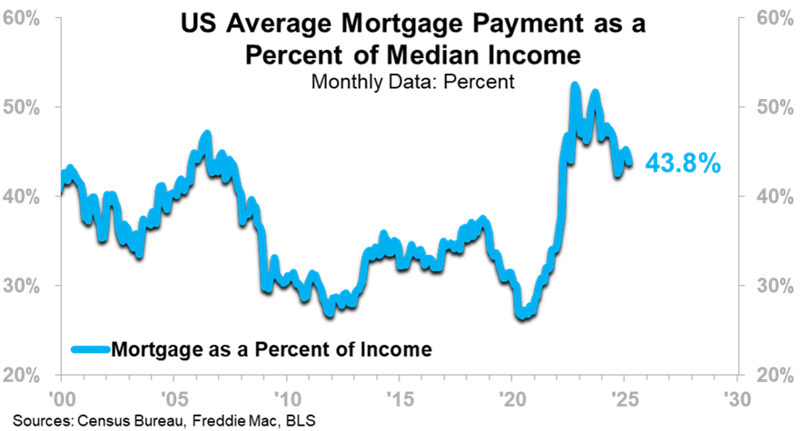

Taking these factors together, the average mortgage payment on a median-priced new home, assuming a 15% down payment and financing at then-current rates, was $2,275 in March. This amounts to about 43.8% of earnings, on average. While elevated relative to pre-COVID levels, this is a notable improvement relative to the 52.6% average mortgage burden as of October 2022 (shown in the chart below).

To be clear, the COVID-era price ramp-up for housing prices outstripped the rise in overall Consumer Prices, and buyers are still adjusting to the sticker shock of higher prices and higher mortgage rates. Buyers may also be more cautious about buying given elevated economic uncertainty, potentially opting for higher down payments or waiting until they have larger emergency funds. Nonetheless, our proprietary leading indicators point to a mild upward trajectory for the US economy overall. As the macroeconomy gains momentum, and if the dust eventually settles on trade policy, buying a home could become a less daunting prospect for many Americans.

A Developer's Perspective

The National Association of Home Builders' Housing Market Index fell in June, coming in at an unfavorable 32.0 compared to 46.0 in December 2024 and the long run average of 51.6. Despite an underlying shortage of affordable housing, developers may be slightly more risk-averse considering a slight uptick in vacancy rates, persistently high interest rates, and ongoing economic uncertainty. Some builders, concerned about a mild pullback in demand, are adjusting spec prices and offering financing incentives. We recently lowered our forecast for US Single-Unit Housing Starts and expect Starts for 2025 as a whole to come in below the 2024 total before growth returns in 2026 and, to a lesser extent, 2027.

Low labor availability and the potential for rising material costs may have builders sweating. Even so, real estate is all about location, and trends can diverge significantly by region – some regions are booming while others are lagging behind.

The Bottom Line

Conditions are not perfect for purchasing a home right now, but it’s not likely to get any better in the coming years. In fact, inflationary pressures from labor shortages, material costs, and potentially higher interest rates in the future suggest that while now is not a perfect time to buy a home, it may be as good a time as any prior to the 2030s depression. If you are considering purchasing a home, we suggest considering the following:

- Carefully assess your ability to purchase at today’s affordability levels. Now may represent a strategic window of opportunity before market conditions shift again.

- City-specific dynamics can vary significantly. Taking a data-driven approach to local economic and population trends may uncover compelling opportunities in high-growth or undervalued areas.

- While the current environment may offer promise, it's essential to maintain financial discipline with a strategy aligned with the outlook for depression in the 2030s. Ensure you are cash rich and have either no debt or are comfortably able to service your debts even if you face strain with respect to your employment, stock portfolio, home valuation, etc.