The monthly North America Light Vehicle Production numbers came in weak for March.

- March Production numbers were down relative to February.

- This is only the third time in the 2000s that March numbers came in lower than February.

- The other two instances were 2020 (the onset of COVID shutdowns) and 2008 (the Great Recession).

A month of data does not constitute a trend. However, other reliable signals suggest that Light Vehicle Production is weakening.

- The 12-month moving total (12MMT) ticked down slightly from February to March; the 12MMT trend has been relatively flat – i.e., stagnant – in 1Q24.

- Production’s year-over-year growth rate, as measured by the 12/12 rate-of-change, continued to decline in March. The growth rate, at 8.0%, has been slowing since a July 2023 peak of 15.5%.

Trends are stronger in the retail side of the automotive industry, but they also suggest some softening.

- The 12MMT for US Light Vehicles Retail Sales a measure of units sold rather than sales dollars, ticked slightly downward in April, and the year-over-year growth rate, currently at 10.6%, is declining further off a September 2023 peak.

It is also worth noting that both the North America Light Vehicle Production trend and the US Light Vehicles Retail Sales trend are below their respective pre-COVID levels.

While the consumer has generally exhibited resilience, contributing to relatively strong GDP despite interest rate pressures, trends in the US Auto Loan Delinquency Rate suggest some headwinds.

- At 4.2% as of 4Q23 (the latest data), the Delinquency Rate – i.e., the percentage of US car loans more than 90 days delinquent – is up from a 4Q22 low of 3.73%.

- The increase in the Rate suggests that more consumers are having difficulties in making car payments.

- The Rate is still significantly below the pre-COVID level of 4.9%.

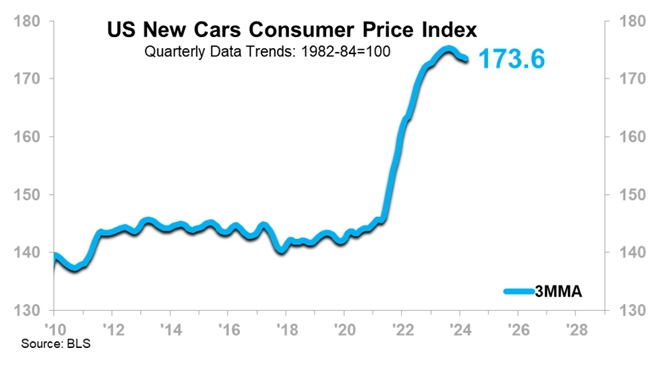

Elevated automobile prices have likely contributed to consumer headwinds. While US New Cars Consumer Prices have exhibited mild decline (three-month moving average basis) in recent months, the 2021–2023 run-up, precipitated by insufficient supply, was unprecedented in severity, as seen in the chart.

Meanwhile, inventory signals are mixed. The US Light Vehicle Month-End Inventory Days Supply been rising since mid-2022, when vehicle supply chain issues began easing. However, at 54 days’ worth of vehicles as of April, the Inventory Days Supply is still significantly below the pre-COVID five-year average of 68.7.

What It Means

Both the Delinquency Rate and Inventory Days Supply trends are favorable from a historical standpoint but currently moving in the wrong direction. If these headwinds continue, the automobile manufacturing industry will stagnate this year and into next. We are forecasting relative flatness, with a downward bias, for North America Light Vehicle Production through mid-2025. If you have exposure in this industry, your growth will have to come via market share gain.

Follow us via an Insider™ membership to stay current on this dynamic situation.