We expect Retail Sales to generally rise throughout the rest of this year. The same cannot be said for Domestic Light Vehicle Retail Sales and likely the all-encompassing US Light Vehicle Retail Sales. The difference will add to the confusion and misinformation about the economy at large. It is important to know why the difference will occur:

- Consumer Expectations matter for automotive retail sales.

- Chaos is the enemy of the automotive market.

- Auto Loan Delinquency Rates are rising.

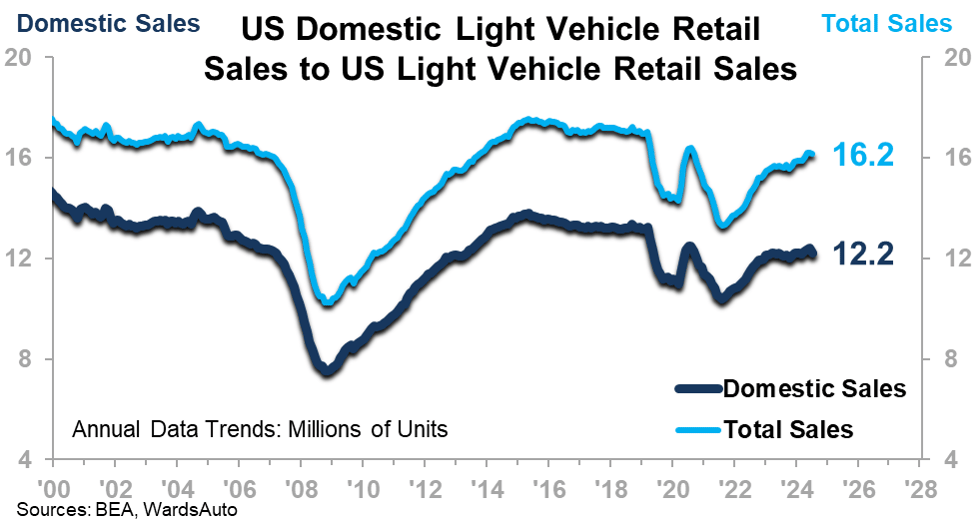

The chart above compares US Light Vehicle Retail Sales to those produced domestically. The trends are very similar, as is the growth status of each. Note that domestically-produced vehicle retail sales have lost ground to the total over the last two years. We expect that the likelihood of decline for both trends in the second half of 2025 is high. What is not evident from the chart is that foreign-produced vehicle retail sales in June also had a bad month, perhaps aggravated by the tariffs. The imposition of tariffs has not been a boon to the domestic sector of the industry thus far. This is because there are other factors in play.

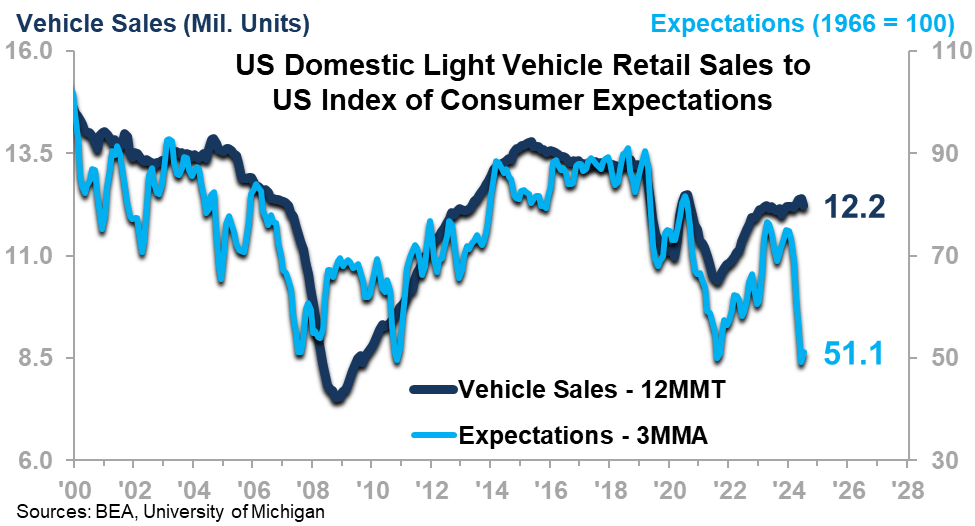

ITR Economics has previously demonstrated that Consumer Expectations have no correlation with overall Retail Sales. However, we have also consistently said that the automotive industry is a notable exception.

The chart shows that declining expectations are a negative upon the automotive industry when it comes to Retail Sales. Macroeconomic factors are such that we do not expect Expectations to drive the industry into an abyss, but clearly, the sooner Expectations engage in sustained rise, the better for this industry. Rising Expectations will likely require a decline in the level of chaos.

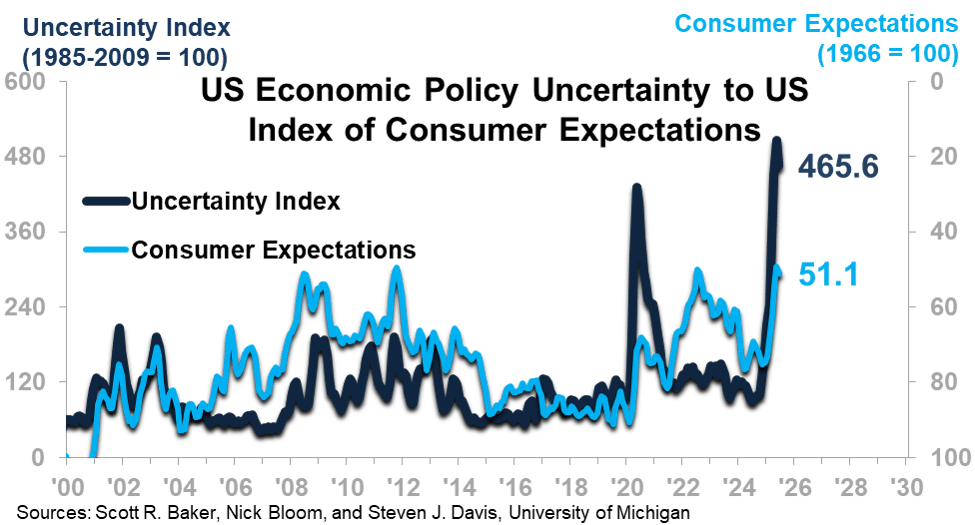

The above chart shows that the US Economic Policy Uncertainty Index (3-month moving average, 3MMA plotted) and Consumer Expectations are related (inversely based on how the data is calculated). Expectations are plotted on the inverted scale to the right. The relationship suggests that Policy Uncertainty has had an adverse impact on the automotive retail sales market. The good news is that the Uncertainty Index is beginning to come down. This is consistent with our prior statements about the level of chaos dissipating in the second half of 2025.

What this means for Light Vehicle Retail Sales is that the economy is nearing the removal of one of the inhibitors to a healthy marketplace, which will allow the industry begin to rise again. However, another issue remains.

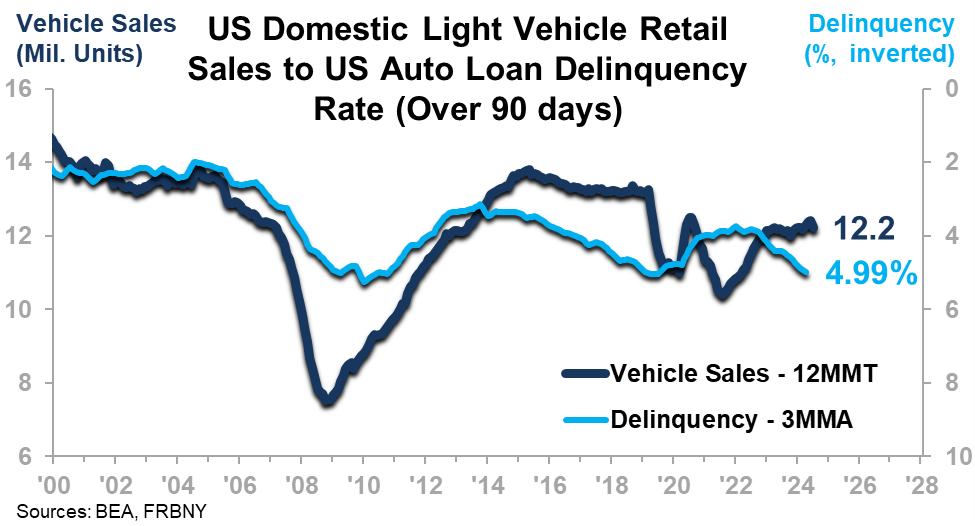

The light blue line is the Auto Loan Delinquency Rate (over 90 days delinquent). It is plotted on the right on an inverted scale so that a worsening delinquency rate can be plotted as a negative. An adverse trend in Loan Delinquency depicts a difficult market environment for Light Vehicle Retail Sales. We expect that this difficult market environment will endure through 2025.

What To Know:

- Lowering interest rates will help alleviate the delinquency rate, but it takes time, and relief will take more than 25 bps of decline.

- Incomes are rising, but that is not enough to lift the industry.

- 2026 will provide more opportunities for automotive purveyors than we see for 2025.