The US manufacturing sector has suffered a bad reputation over the past several decades.

It’s risky. It’s expensive. It’s dying.

Fortunately, those views are largely misconceptions, and the latest data paints a different picture of manufacturing in the United States, especially relative to other manufacturing-focused economies around the world.

Manufacturing Supply-Chain Risks

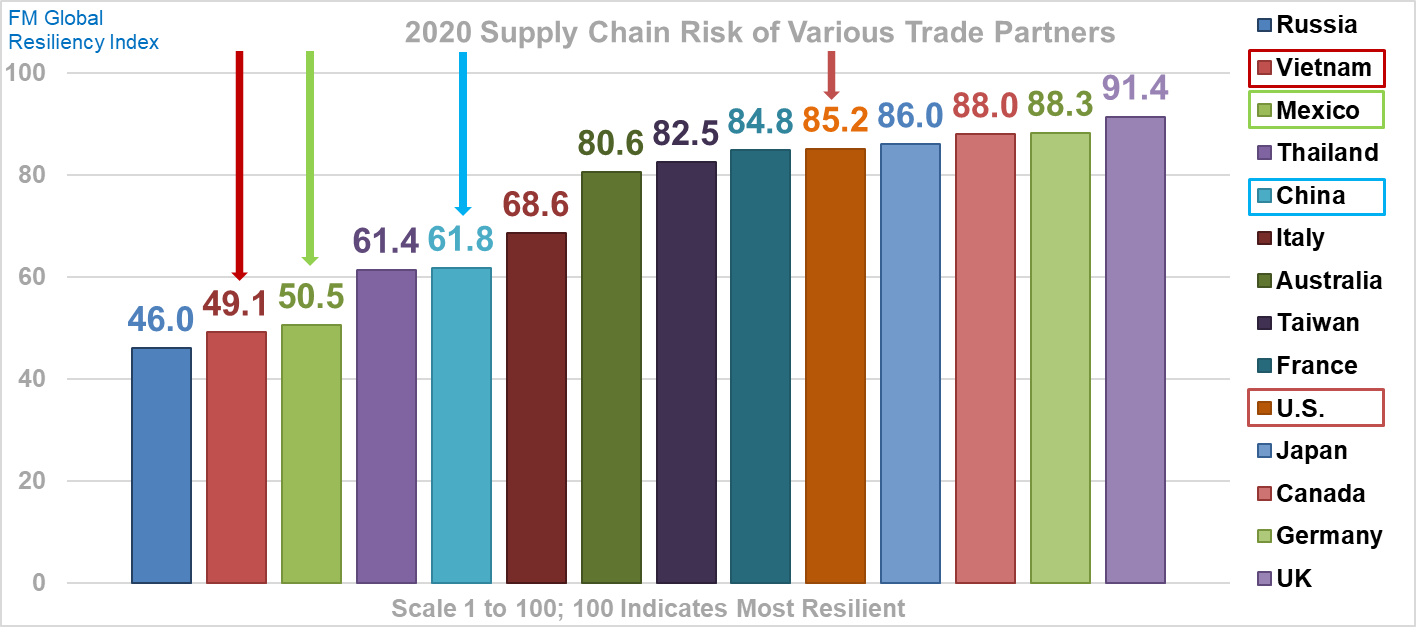

The FM Global Resiliency Index assesses the supply-chain risk of various countries on a scale of 1 to 100, with 100 indicating the most resilient. The 2020 Index output ranks the US at 85.2, far ahead of China (61.8), Mexico (50.5), and Vietnam (49.1) – all top outsourcing targets for US companies. This data paints the US in a very favorable light, particularly in a post-COVID world wherein supply-chain risk is top-of-mind for many business leaders.

Manufacturing Costs

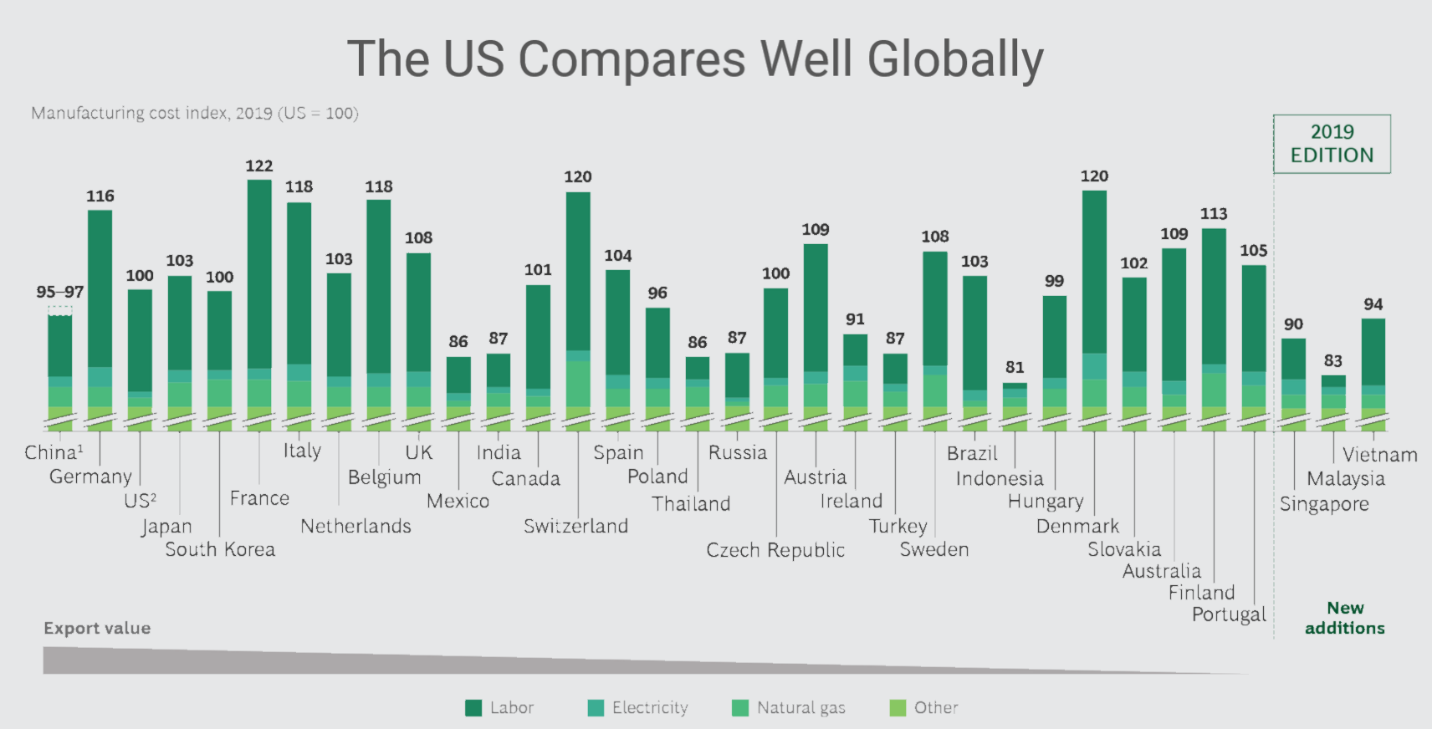

The perception that manufacturing in the US is too expensive, especially relative to countries such as China, Vietnam, and Mexico, which have benefited from outsourcing over the past several decades, is also outdated. According to recent analysis by the Boston Consulting Group, the US compares well globally on a Manufacturing Cost Index basis.

In the assessment, which took into account the total cost of labor, energy, and other inputs in 2019, the US has an index value of 100. The other countries' Index values are:

- China – 95-97

- Vietnam – 94

- Mexico – 86

In other words, Chinese manufacturing costs are only 3-5% lower than those of the US, while Vietnamese and Mexican costs are 6% and 14% lower, respectively. However, those savings must be viewed in context of those countries’ supply-chain vulnerabilities, which, as noted above, are significantly higher than those in the US.

Key Takeaways

The impacts of recent trade wars and the COVID-19 pandemic present long-term potential upside for the US manufacturing sector as companies reconsider supply-chain risks, assess their cost structures, and seek to develop alternate sourcing methods through reshoring. Contrary to the misconceptions, reliable data shows that US manufacturing competitiveness, when considered holistically, is well-positioned relative to the rest of the world. This supports our assertion that manufacturing companies need to plan with optimism and invest for growth in the coming decade. If you’d like to discuss how this can benefit your business, please reach out to us. We’re here to help!