ITR Economics is forecasting a soft landing for GDP in late 2022 and into the first half of 2023. (Please note that a hard landing, or recession, would be two consecutive quarters of GDP 3MMA decline.) There are various reasons for confidence in our forecast, and US Single-Unit Housing Starts is providing a solid foundation for that outlook.

The Single-Unit Housing Starts 1/12 rate-of-change is rising off an October 2021 low, which is wholly consistent with our forecast for an August 2022 Housing Starts 12/12 low and an early-2023 GDP 3/12 low (both according to normal timing relationships).

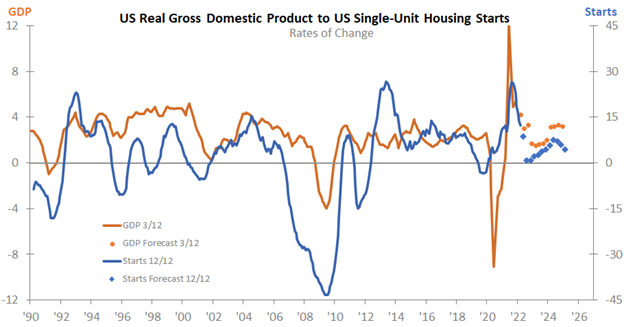

Here is where the analysis gets even more interesting: the Housing Starts trend is not only providing input on the timing of the GDP low, but also the severity of the GDP 3/12 low. The chart below shows that there has been no instance in the last 30-plus years where GDP went negative while the Housing Starts 12/12 stayed positive at a trough.

The Single-Unit Housing Starts 12/12 is not expected to move into negative territory during this cycle, and our ITR Trends Report™ provides greater detail to why.

From a high level, here is why: January and February changes in Single-Unit Housing Starts were close to median, and our projections show Single-Unit Housing Starts avoiding 12/12 decline this year. Even if we took a pessimistic view, with weaker-than-normal activity for the last decade through the third quarter of this year, the Single-Unit Housing Starts 12/12 stays above zero. The chart above clearly shows that the Single-Unit Housing Starts 12/12 staying above zero is a very good sign for the GDP 3/12 also staying above zero.

Rates-of-change and cyclical relationships provide a powerful and accurate means of seeing the future, and in so doing distinguish the truth from fiction and fear. Knowing where your 12/12 will go – either up or down, and to what level – allows you to budget, plan, and act with confidence. Please head to our website for more information on how to use this powerful tool.