Why Will It Be a Prolonged Decline?

Essentially the question revolves around central bank intervention through increased liquidity and lower (and perhaps negative) interest rates, and whether Fed intervention may hold the key to shortening the decline to a more normal recession.

The longevity issue as opposed to a normal one- to two-year recession gets to the heart of the matter regarding what defines depression versus recession.

- Inflation will continue after the depression starts, meaning the cost of money continues to rise for years following the onset of the depression. That will create stagflation. The inflation makes it difficult, if not impossible without risking hyperinflation, for the Fed or any other central bank to lower interest rates to reverse the decline in the economy.

- Additionally, deficit spending before and during the early years of the period means years of interest payments at higher interest rates will consume more and more of the federal non-discretionary budget at a time when the aging population demand more and more in the form of transfer payments (social security and health care to name but two sources of demand).

- We see the negative interest rates (at least nominally) occurring as inflation ebbs and eventually turns into deflation. We see the lower interest rates as part of the “cure” as the questioner does; we differ on the timing because of the inflation issue.

China's Demographics

ITR Economics has stated that China’s declining demographics are a problem that will contribute to that nation’s economic decline in the 2030s. The query suggests that China, as a communist country, is already combatting their demographic issues with subsidies for families, and if they need to, they can enact laws to help offset the demographic decline.

We see things a little differently here also. China cannot afford the level of subsidies needed to counteract the declining population. The burden of the aging society with fewer people working combined with the highly leveraged status of the economy (and the resulting inability to leverage their way into growth as they have done in the past) suggests to us that there are limits to what the communist government can do in this regard. Regarding enacting laws, I do not see how laws can help a population problem within 20 years, even if they were to mandate population growth. We see the communist party recognizing the reality of these limits via increasing the party’s power, clamping down on capitalism and capitalists, and further squelching human rights. They appear to us to be seeking to control the aftermath of the trends rather than proactively managing the trends themselves.

Japan as a Role Model

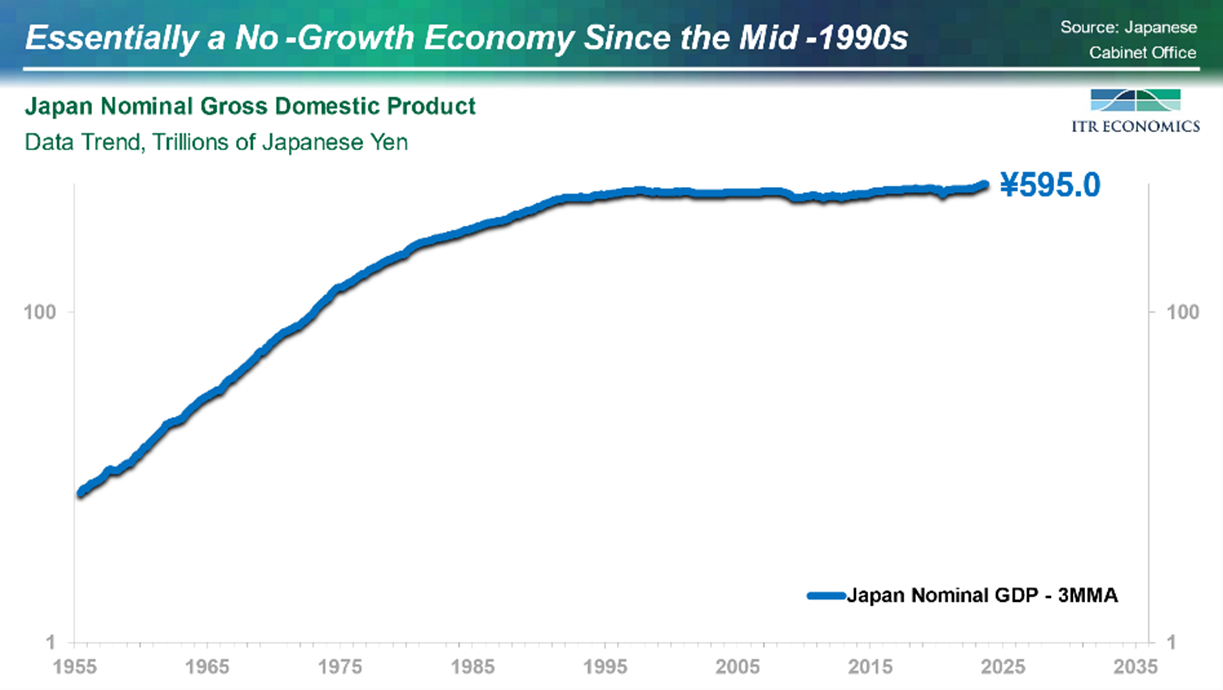

“Japan went through something similar over the last two decades and generally has had a low but positive GDP.”

Japan is indeed in slow-growth mode. The declining population is holding growth down and contributes to Japan’s deflation (you will have noticed that China is contending with deflation as well, while the rest of the world experiences inflation). Japan is currently 4.21% of global GDP (nominal). Japan’s apex since 1980 occurred in 1994 at 18.24%. China has easily eclipsed Japan, just as we may see India eclipse China over the next 30 years.

Japan’s GDP growth is an interesting exercise in perspective. Please see the chart immediately below.