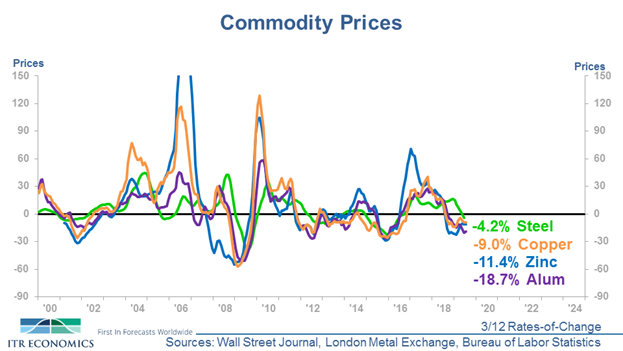

What do the quarterly growth rates for Steel, Copper, Aluminum, Zinc, and Oil Prices have in common? They’re all declining below year-earlier levels. It’s amazing how quickly things change in just a short time.

The pricing environment during 2017 and the first half of 2018 was characterized by elevated commodity prices. This translated to high input costs and pressure on margins. For many firms, price increases were necessary to maintain those margins and ensure profitability. However, as we know, not all these pressures were due to market forces and simple supply and demand fundamentals. Tariffs added an extra layer of complexity to prices. This is especially true for steel and aluminum.

Notice that the trends of 2017 and 2018 are not carrying us through 2019. The chart above displays the 3/12 rates-of-change for several of the most popular commodities. All four commodities charted are below their respective year-ago levels. When you also consider the current -15.5% quarterly comparison to a year ago for Oil Prices, you can clearly see the theme here: decline. This price decline may be a welcome sight for many but a bit of a depressor, or even a worry, for others.

Is there more decline on the horizon, and when exactly is the low point of this business cycle likely to occur? What does this mean for the US economy at large? For global and domestic firms? We will review these questions in greater detail August 27. Attend our webinar and learn what the leading indicators are telling us and where commodity prices in the US are heading for the remainder of this year and next.

Taylor St. Germain

Analyst and Speaker