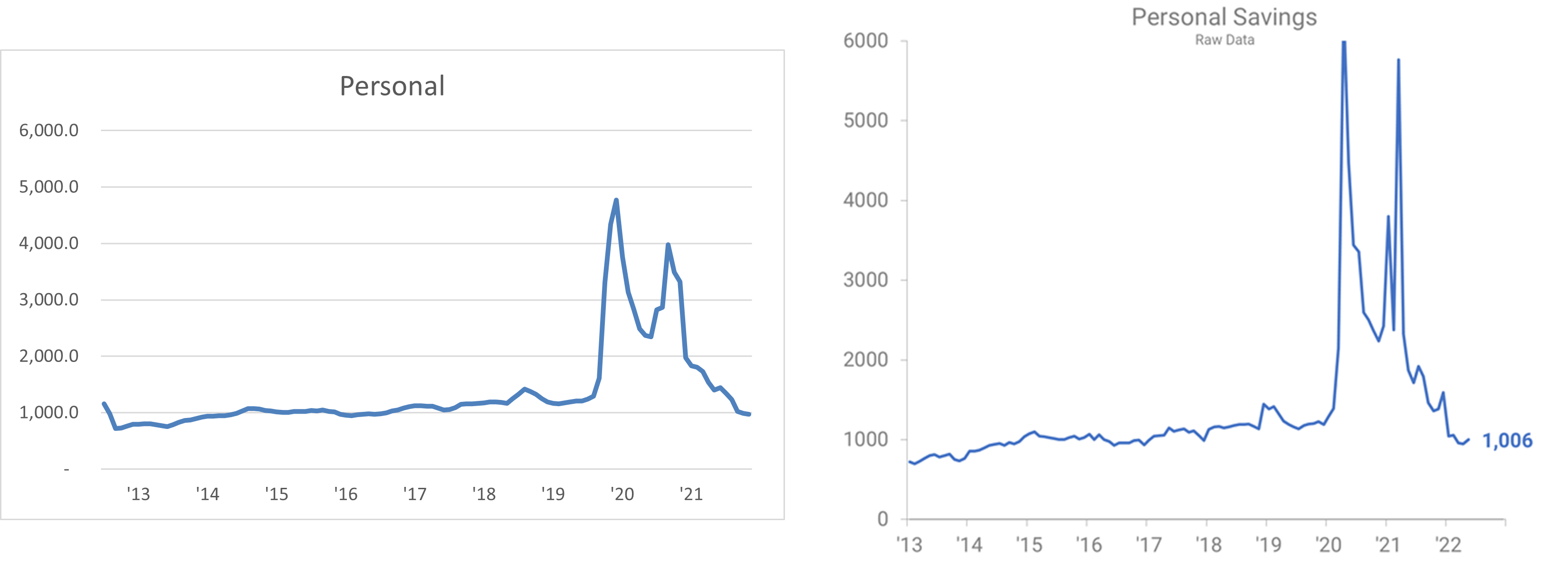

Consumers benefited from mounds of cash pushed their way by government stimulation during the pandemic. The financial windfall fueled an incredible surge in Retail Sales and contributed to disruptions in the supply chain. The windfall money appears to be gone. We spent it.

The chart shows that the level of Personal Savings in the US is essentially back to what was the norm from 2014 through 2019. GDP (adjusted for inflation) grew every quarter during that period, with the sole exception of a mild decline in the first quarter of 2014. That track record tells us that the “low” savings (as some are describing it) are really a return to the old normal, and the old normal did not result in recession at the macroeconomic level.

The above analysis concerning GDP does not mean that all markets will escape a downturn.

Markets that benefited from the COVID-Surge, which stemmed from the influx of free cash and the need to stay home, will be adversely impacted in 2022 and likely the first half of 2023 in some instances. The ascent was unnatural, and inventory ordering was aggressive. Now that the consumer has “backed off” from the torrid pace, there is too much inventory. Excess inventory will lead to a decline in orders in those markets. The weakness will last for as long as it takes for the inventory to clear out. The drop should not be construed as a normal recession per se, because it is limited to COVID-Surge circumstances. The consumer floor is not at a recession level; it is at the “normal” established pre-COVID. Given that all trends tend to overshoot the mean, most likely a company’s experience will also overshoot the pre-pandemic mean. However, the malaise at the company level in total should not be deep enough or broad enough to bring down GDP.

Clearing out inventory frequently means price decline via “sales” of one sort or another. Which leads us to the macroeconomic upside to returning to normal Personal Savings.

ACTION ITEM: Determine if any part of your business benefited from the COVID-Surge and assess whether the inventory in the pipeline is appropriate to a return to pre-COVID normal. Adjust your budgeting accordingly.

The Consumer Price Index (CPI) is indicating an inflation rate of 8.5% (3/12 rate-of-change). Personal Savings have returned to normal, and having less money in the bank is consistent with the decline in the M2 measure of the money supply (deflated). While the fit is not perfect (see 2011-2012), the M2 1/12 leads the CPI through cyclical reversals by a median of 17 months. The M2 trend line is accordingly shifted “forward” (to the right on the chart) by 17 months. The relationship shows that we are on the cusp of seeing the inflation rate begin to come down. Part of the reason this occurs was described above: the return to normal consumerism and the discounting of excessive inventories in some markets. Another partial answer is the overall lessening of increasing demand as the global economy decelerates. Additionally, as reported by the Federal Reserve, supply chain pressures seem to be easing in most districts based on manufacturer-reported lead times.

Anticipate a lessening of inflation pressures at the consumer level and the business-to-business level. Gauge your own effort to increase prices accordingly. Clearly some markets that are having trouble growing (the above examples as well as single-family housing) will react negatively to attempts to push prices too far too fast. There was a pervasive acceptance of higher prices when we were on the upside of the cycle. That acceptance is likely shifting to “push-back” as we round the high and head toward the next inflation low.