Despite the Federal Reserve’s 50 bps decline in the Federal Funds Rate in September, the inverse yield curve remains in place when using the traditional approach of comparing the US 10-Year Government Bond Yield to the Fed Funds Rate. In normal times, short-term rates like the Fed Funds Rate should be lower than the 10-year rate because the latter comes with more risk. Why is the inversion still in place using this measure? Because the market priced in a larger interest rate decline for the 10-year bond relative to the Fed’s 50 bps decline. The Fed is still behind the curve relative to the marketplace.

The chart below illustrates that the Fed Funds Rate is 92 bps “too high” relative to market pricing on the long bond yield. Prior to the current FOMC, the Fed would take its cues from the marketplace. Historically, we would infer from the chart that the Fed will be dropping rates another 100 bps from here. We think it best if you do not count on such largesse from this Fed.

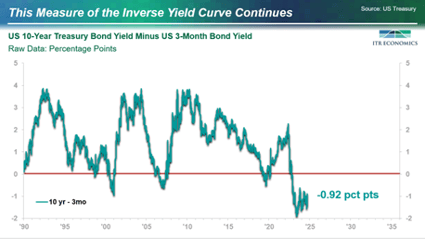

The enduring nature of the inversion neatly typifies the unusual characteristics of the current business cycle. It gets more convoluted when examining two other measures of an inverse yield curve, as demonstrated by the charts below.

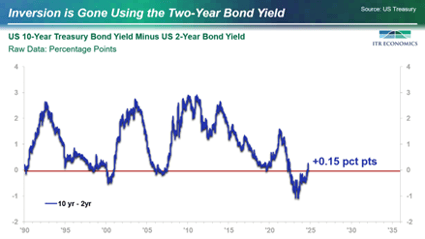

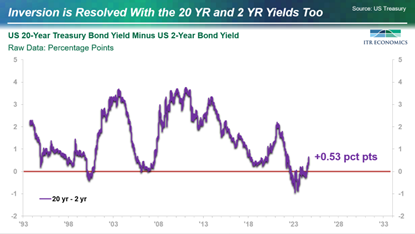

The US 10-Year Government Bond Yield versus the US Government 2-year yield is resolved. The +0.15 percentage point differential puts the relationship back into normal territory. The same is true using the 20-year yield to the 2-year yield given the +0.53 percentage point differential.

The Takeaway

Two of the three inversions have resolved themselves. As the artist Meat Loaf taught us in 1977, “Two Out of Three Ain’t Bad.” There is very little that is normal as we transition through the end of the current business cycle and into the rising portions of the next business cycle in 2025. We are likely looking at a situation where the Fed is being too slow to lower interest rates and, in doing so, impeding the timing and/or strength of the next business cycle.