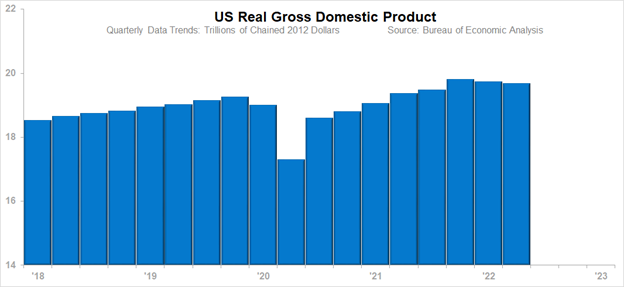

It is official. GDP (adjusted for inflation) met the definition of a recession when it declined for a second consecutive quarter based on the 2Q22 advanced release. What this means is now the question.

-

Clearly companies or markets that benefited from the stimulus money and the circumstances of the pandemic (no travel and people staying at home) are exposed to the weakness suggested by the advanced GDP result. Excess inventory will have to be cleared until such time as the market is back in balance between demand and supply. Expect prices (at all levels in these segments) to be lowered as a means of clearing the excess inventory. For those segments that benefited the most from the COVID-related spending, the return to a balance between supply and demand will be a function of how high demand was above the longer-term trend.

Other parts of the economy will perceive the probable two quarters of decline as a “technical” recession because the pressures that pushed the overall economy downward did not appreciably impact them. These companies are more likely able to benefit from several factors:

- Consumers continue to be engaged in the economy, as evidenced by their spending money (on different items than last year to be sure, but retail sales are rising nonetheless).

- Wages are rising.

- Inflation is coming down.

- Exports are rising.

- Supply chain distortions are easing.

- Near-sourcing is occurring.

- It is too early in the timeline for the rise in interest rates to be taking down the economy (if indeed that happens).

It will be a while before the first half of 2022 is officially declared a recession or not. Either way that decision goes, GDP declined during a period we were expecting the economy to be essentially flat. Going into 2022, we had three ways to view the coming year:

- Decline was going to have to occur because of the withdrawal of stimulus money.

- The economy would trend essentially flat while waiting for the status to essentially “normalize” to where we otherwise would have trended over the course of 2022.

- The economy would continue blissfully on because of higher wages, and the government was not going to spend less money than it did in 2020 and 2021.

We chose view #2 as our guiding principle. Some segments of the economy would go down, more would go up, and on balance we would have an essentially flat trend in GDP. Given the extremely mild first-quarter decline and the even milder second-quarter estimate, that isn’t exactly how it worked out. The economy sagged slightly, while we forecasted an essentially flat trend. We think we missed on the following:

- The government reduced spending more than we anticipated.

- Inventories are not balancing with demand quickly enough.

- Housing is experiencing greater difficulty than we projected (trending slightly lower instead of essentially flat).

- The Ukraine war brought on disruptions to normal economic trends.

- We underestimated the aggressiveness of the Fed’s response to inflation going through 2Q22.

What the missed forecast means:

- 2Q22 GDP looks likely to come in 3% below the median of our forecast, which was prepared with data through December 2021.

- The Management Objectives™ espoused for specific companies generally hold true unless they are part of the COVID sag (including tied to government spending).

- A revision to our GDP forecast might be necessary, but we will likely wait, as it looks like the current 1.3% deviation from the forecast is what will hold for the year as a whole, and the latest data is subject to revision.

We don’t think the two quarters of decline in GDP should change your plans for the rest of this year or 2023 in terms of direction and general amplitude. If you receive an EVP service or other specific forecast service from ITR Economics, don’t expect to see many changes, because industry-specific forecasts are not that reliant on GDP for guidance.

If you tie more closely to US Industrial Production than GDP, you have a clearer view into the future. Industrial Production is growing. It is not in recession. Slower growth remains the outlook based on the latest available data from the leading indicators.