The US government allocated trillions of dollars in stimulus spending to prop up the economy and mitigate the impact of this black swan-driven recession. Ongoing negotiations on Capitol Hill could result in further stimulative actions, funded by additional deficit spending on the part of the federal government. We’ve received many questions about this topic, specifically regarding whether this is a near-term downside risk to the US economy. The short answer is no; we don’t think so.

The longer answer can be broken down into three separate parts and is facilitated by three accompanying charts:

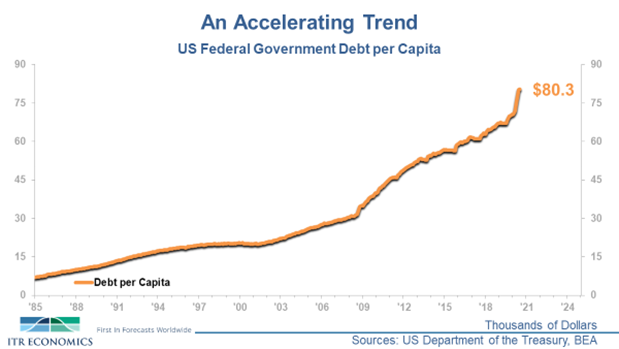

- US Federal Government Debt per Capita has risen sharply since the various components of the stimulus package were put in place this spring. It now exceeds $80,000 per person, up nearly 15% relative to the beginning of this year.

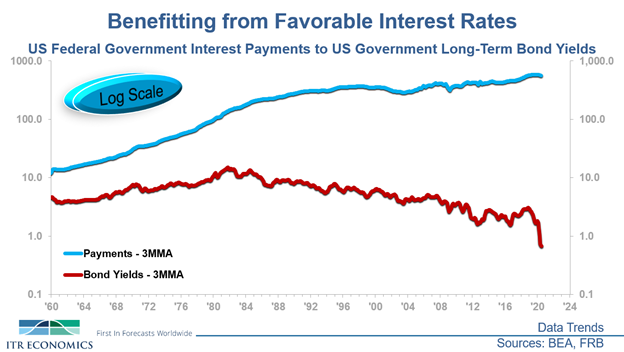

- Despite the notable increase in the rate of rise in US Federal Government Debt per Capita since early 2020, the low-interest-rate environment is offsetting a lot of the pressure for the government to meet its debt obligations, particularly when it comes to US Federal Government Interest Payments. The current three-month moving average for Bond Yields is hovering around 0.67% for the 10-year Treasury note. This is less than half of the 1.71% average rate seen in the three months prior to the pandemic and represents a substantial decrease in long-term borrowing costs for the US government. As seen in the chart below, the government’s interest payments have not seen a drastic increase in recent months despite the higher debt burden.

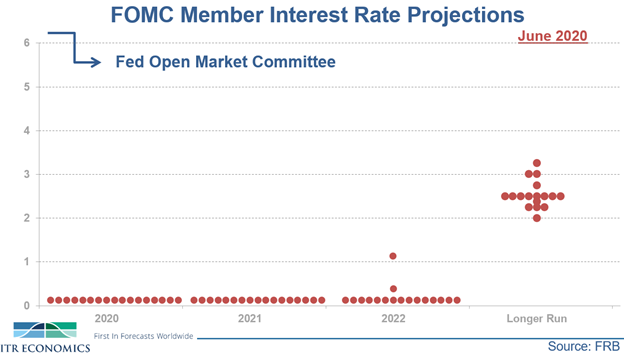

- Current Federal Open Market Committee expectations are to keep the Federal Funds Rate – which is the basis for many other forms of yield, including for Treasuries – at or near zero through at least 2022. Low short-term rates should help mitigate upward pressure on interest payments in at least the near term.

These developments support our assertion that the run-up in long-term government debt is not likely to become a problem for the economy in the near term. It is likely that the negative ramifications will be more significant as we get closer to the Great Depression we are forecasting to begin around 2030. In the meantime, ITR Economics is advising our clients to take advantage of the low-interest-rate environment and position their companies to capitalize on the rising business cycle trend we expect to emerge in 2021.

If you’d like to discuss how this pertains to the most important part of the economy – your business – please reach out to us. We’d love to discuss it with you!