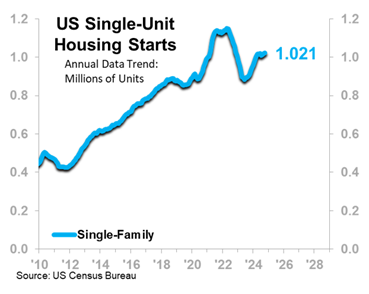

Previously, we discussed the US Single-Unit Housing Starts trend, a key bellwether for the overall US economy, and how it has recovered and stalled once again in the wake of the decline that occurred from mid-2022 to mid-2023.

Housing affordability has been an issue since the COVID-related boom that preceded the aforementioned steep decline.

- However, we expect that rising real incomes and likely ongoing easing in the Federal Reserve’s monetary policy will continue to chip away at the affordability issues that have hindered this market.

- We are expecting US Single-Unit Housing Starts to return to a rising trajectory in the first half of 2025.

- The trend will persist through at least 2026.

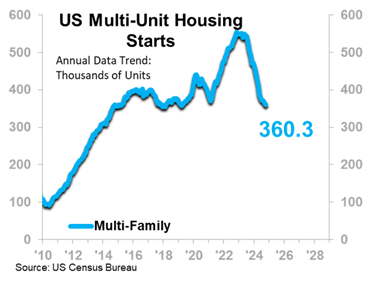

The Multi-Family Segment

A market that gets less attention is US Multi-Unit Housing Starts, partially because it accounts for a smaller overall portion of the overall housing construction market, and also because it is less reliable as a leading indicator to the US economy. Additionally, the multi-family market provides less of an advance warning due its lead time of about 3-4 months relative to Single-Unit Starts’ 9-month lead.

Still, the multi-family segment is a significant part of the housing market, and it is worth noting that the Multi-Unit Starts 12MMT has been on a decidedly downward trajectory since the Fed took a hawkish tack in 2022 and 2023, raising the target interest rate an average of 31 basis points per month for 17 months.

- The US Multi-Unit Housing Starts 12-month moving total (12MMT) has declined 35.0% since a late-2022 high.

- The Starts 12MMT is below the pre-COVID level.

- The Starts 12MMT was at 360.3 thousand units in October, 26.4% below the year-ago level.

Despite this negativity, the multi-family market is on the cusp of a positive trend.

- Multi-Unit Starts are in Phase A, Recovery. The 12/12 rate-of-change reached a low in July and has since been rising.

- Rise in the 12/12 does not mean that the Starts 12MMT is rising; it still declining, but the rate of decline is slowing.

- We expect that the rate of decline will slow to the point that decline ceases altogether and the Starts 12MMT begins to rise on a year-over-year basis, ultimately entering Phase B, Accelerating Growth.

In Phase A, it can be difficult to believe that Phase B is coming.

In the day-to-day, as your view of the market and your revenue stemming from the market go down, and inquiries are fewer and farther between, it is easy to identify that the market is declining. It is harder to discern that the rate of decline is easing as a prelude to eventual recovery. Even when you calculate your rates-of-change and identify with mathematical certainty that the rate of decline is indeed easing, it is emotionally difficult to accept that the decline will slow, the data will reach a low, and rise will take hold thereafter.

But at ITR Economics, we have seen it happen time and again. If you have data for your company going back at least several years, we can likely show you where it happened for you in the past.

For Multi-Unit Housing Starts, it happened in 2010 and 2018.

With Phase A expected to give way to Phase B in in the second half of 2025, business leaders involved in the multi-family housing construction market need to prepare for the forthcoming rising trend.

- Identify the things that you are doing now – products, services, or clients – that may be bringing in cash flow, but not profit. Either quickly make these actions profitable or consider dropping them altogether. You will need capacity to handle market expansion in 2025.

- With nationalism on the rise, most recently in the form of renewed rhetoric around tariffs, take a hard look at your supply chains. North American suppliers will be “safer” than overseas suppliers, and domestic suppliers will be safer still.

- If you have been struggling with high inventory and are continuously trying to whittle it down, now may be the time to stop.

For more about the multi-unit market or what to do at this juncture of the business cycle, contact us at ITR Economics.