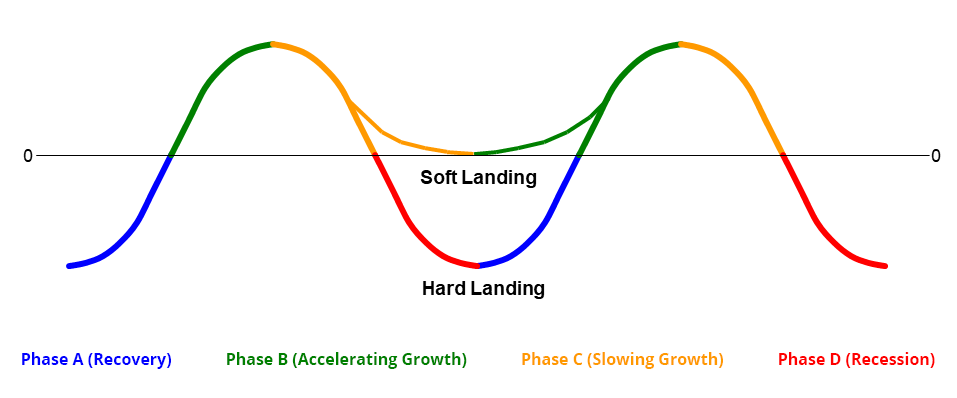

There is a reason ITR Economics uses rate-of-change to identify four distinct phases to the business cycle: Each phase requires a particular perspective in conjunction with a view to the future.

The US economy is on the threshold of the third phase of the business cycle, Phase C. The "C" stands for "Caution," which is what we urge most folks to use when thinking about the next four quarters. Caution is warranted if you tend to move in sync with any of the following measures: GDP, Retail Sales, US Total Industrial Production, Manufacturing, or Housing.

We are in that relatively unique stage of the business cycle in which the data is still generally rising (or seems to be at first glance), but the upward movement is definitely decaying. This is Phase C. It is a period of Slowing Growth. Not slower growth, but slowing, because it is a progressive phenomenon. The economy will continue to decelerate until it either (a) enters into a recession (negative growth), or (b) shifts into accelerating rise without first going through a recession. The latter is the proverbial "soft landing." This business cycle will have elements of both (a) and (b). Retail Sales will experience slowing growth without subsequently contracting; Housing (a traditional leading indicator) is already beginning to contract.

ITR Economics presenters frequently provide our leading indicator analysis in webinars, company-specific meetings, and trade association meetings. The leading indicators tell a great deal about how much slowing is likely to occur. Sometimes the signs are relatively subtle; here are three of those subtler (and worrisome) signs:

- Adjusted for inflation, Retail Sales are now barely rising, and the 12/12 rate-of-change is below 2.5%. (The 12/12 is at 2.2% and declining; the 3/12 is at 0.8%.)

- Food Services and Drinking Places Retail Sales activity is now shifting into Phase C. (The 12/12 is edging upward at 6.3%, but the 3/12 is at 5.3% and declining below the 12/12.)

- Light Vehicle Retail Sales (passenger cars and light-duty trucks) over the last three months came in 0.7% below the year-earlier level for the same three months.

It is easy to see why people can miss these signals. They tend to focus on a snapshot of the data rather than the trend. This is one reason why many otherwise good decisions are made at the wrong time.

In other cases, it is simply a matter of not knowing enough of the circumstances. Single-Unit Housing Starts are in Phase C, Slowing Growth. However, Starts over the last three months are down, by 9.3%, from the same three months one year ago. Starts are trending lower.

There is a tendency to attribute this to there not being enough inventory to keep housing going. But that misses the point that these are Housing Starts we are talking about, not sales. The data for Building Permits, which lead Starts, shows that further downward cyclical change is ahead.

Knowing where you are in the business cycle and basing your decisions on the reality of where you are trending is key to making decisions with near-term profitable payback.

It’s as easy as A – B – C – D.

Brian Beaulieu

CEO