If you did the grocery shopping in the early spring of 2020, you probably bought everything you thought you might need for at least the next two weeks and then some.

Businesses behaved in a similar way, though their overstocking came a little later. It happened:

- After the consumer panic-buying was in full swing (a signal that the pandemic was not going to squelch consumer demand)

- And after the shutdowns hobbled supply chains (a signal that obtaining the necessary materials and components to get finished goods to market and fulfill that consumer demand was not a given)

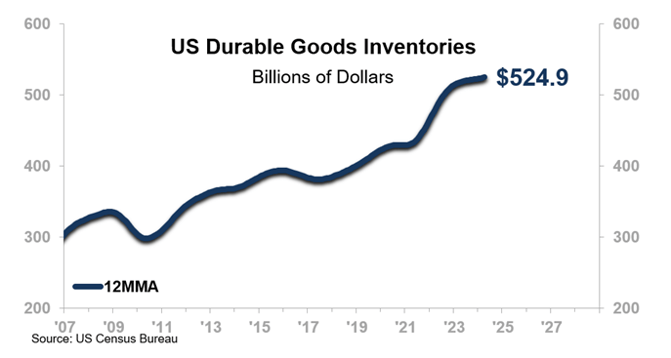

The chart shows the sharp, pandemic-related rise in US Durable Goods Inventories from early 2021 into about the first half of 2023.

The inventories issue is another COVID-echo that helped lead us to the relative economic stagnation we are experiencing in 2024. Elevated inventories are both a symptom of economic headwinds, indicating that buyers are buying less relative to expected demand. At the same time, they are a contributor to those headwinds as they tie up companies’ cash and capacity to the detriment of spending and production.

Look at the chart again. Since the middle of 2023 or so, inventories have trended relatively flat. While still above trend, they are normalizing, which is helping prepare the way for the macroeconomic acceleration we are expecting in 2025.

We have heard from clients that both their own inventories and their customers’ inventories have begun to normalize, starting around the second half of 2023. There is also evidence in the data.

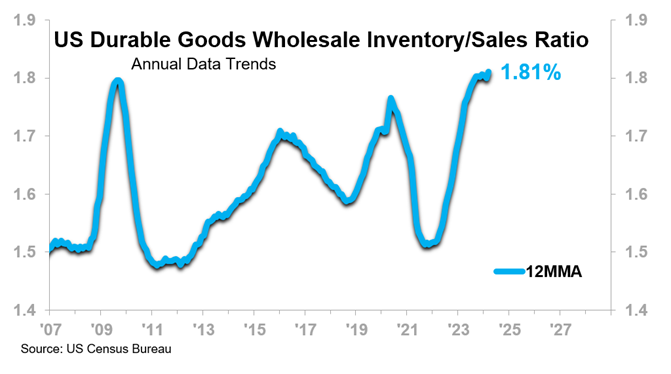

The US Durable Goods Wholesale Inventory-to-Sales Ratio, a measure of inventories relative to sales, is in a well-defined Phase C trend. In recent months, the rise in the 12-month moving average (12MMA) has eased significantly, in contrast with the relatively steep rise that had characterized 2022 and much of 2023. The leveling of the Ratio 12MMA affirms a re-balancing into a normal relationship.

The recent trend in the Ratio means that the level of inventories relative to sales is moving toward improvement, a favorable economic signal that ties into our outlook for improved growth next year in the overall macroeconomy, including the industrial sector and wholesaler-distributor space.

What it Means

Normalizing inventories signal that ordering behaviors are returning to something closer to pre-pandemic norms. If your customers are conforming to that trend, you may find an opportunity to improve operating margins in 2025.

The inventory trend is also a green shoot that foreshadows the economic rise coming in 2025. If you are not already preparing for that, now is the time. Follow along with us as we identify other green shoots in the months to come.