The January jobs numbers landed with fanfare, and phrases such as “blowing away expectations” dominated headlines and soundbites.

The numbers – “more than 300,000 jobs added in January” – were relatively strong, but as far as blowing away expectations, it would depend on whose.

- The dataset the media typically quotes is seasonally adjusted and includes workers in both the private and public sectors.

- Without the seasonal adjustment, the same dataset, US Nonfarm Payrolls, shows that private and public jobs decreased, from 158.3 million in December to 155.6 million in January.

It is important to note that, despite the decrease in the unadjusted numbers, the media optimism around the January report is understandable.

- The unadjusted Monthly Payrolls data always declines from December to January – that is the norm.

- This January’s decline was among the softest in the history of the dataset, which goes back to 1939.

- The softness of the January decline was apparent in other employment datasets, such as US Private Sector Employment, which is not seasonally adjusted and does not include public sector jobs. It is the employment metric we track, with new analysis every month in the ITR Economics Trends Report™.

However, the employment data is not all sunny.

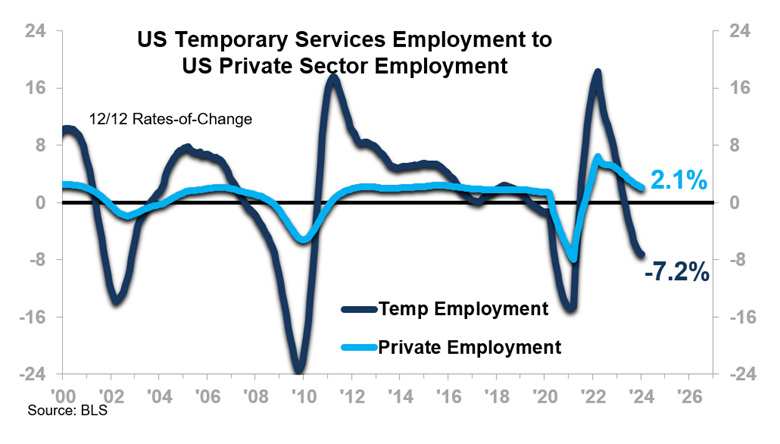

- US Temporary Services Employment, a measure of workers employed on a temporary basis, has been declining on a 12-month moving average basis since late 2022 and is in Phase D, Recession (i.e., the 12/12 rate-of-change is below the zero line and declining).

- As seen in the chart, a Phase D trend in Temporary Services Employment (blue line) typically precedes a Phase D in US Total Private Sector Employment (with the exception of the COVID-induced recession, in which everything fell more or less simultaneously and precipitously).

It is also important to note that the fact that the US Private Sector Employment 12MMA is at a record high and still rising, for now, is not necessarily a bullish signal for the industrial economy.

- The overall industrial economy leads Employment – i.e., downturns in US Total Industrial Production tend to precede downturns in Employment.

- US Total Industrial Production is currently declining, and Phase D, Recession, is imminent.

What It Means

You can expect some easing in the labor market later this year, but it will be just that – an easing, not a 180-degree change in the labor market dynamic. We still anticipate that relative tightness will characterize the labor market for the rest of the 2020s.

Furthermore, US labor market trends will vary by region and market. ITR Economics Senior Forecaster Connor Lokar delves into these granular insights in his Business Series Webinar, “Labor Market Trends – 2024 Opportunities and Challenges,” available to ITR Economics Insider™ subscribers.