I saw this headline: “Consumer spending slowed in July as inflation remained…” I read that as a clear statement of correlation between something vaguely negative (“slowed”) and inflation. Reality is different from what was conveyed in the headline.

Retail Sales, deflated so we immediately remove the question of inflation, moved slightly lower from June to July − a 0.62% decline. The decline was milder than last year and milder than average. It was a good month for Retail Sales. The seasonal rise from March through July (3MMT trend) came in at 9.1%. The 10-year average is 9.5%. The overall consumer trend is consistent with our projection of a soft landing in the US economy this year.

We are entering into a period of disinflation, which means the rate of inflation will be easing. This should be encouraging to the segment of the population that is feeling pain from inflation pressures and to those who think that inflation will bring about a consumer- and business-led recession.

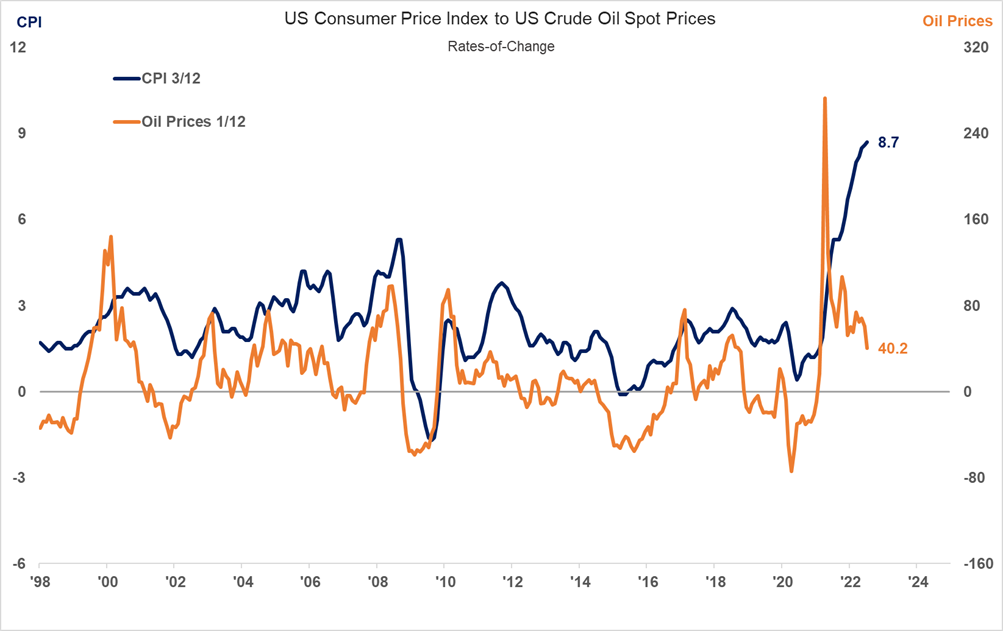

Two of the many leading indicators of that disinflation are shown in the charts below. The first shows that the US Crude Spot Oil Prices 1/12 is declining (orange line on the chart). This is a clear and consistent signal that the Consumer Price Index (CPI) 3/12 will be reaching a peak in the very near term and that disinflation is on our doorstep.

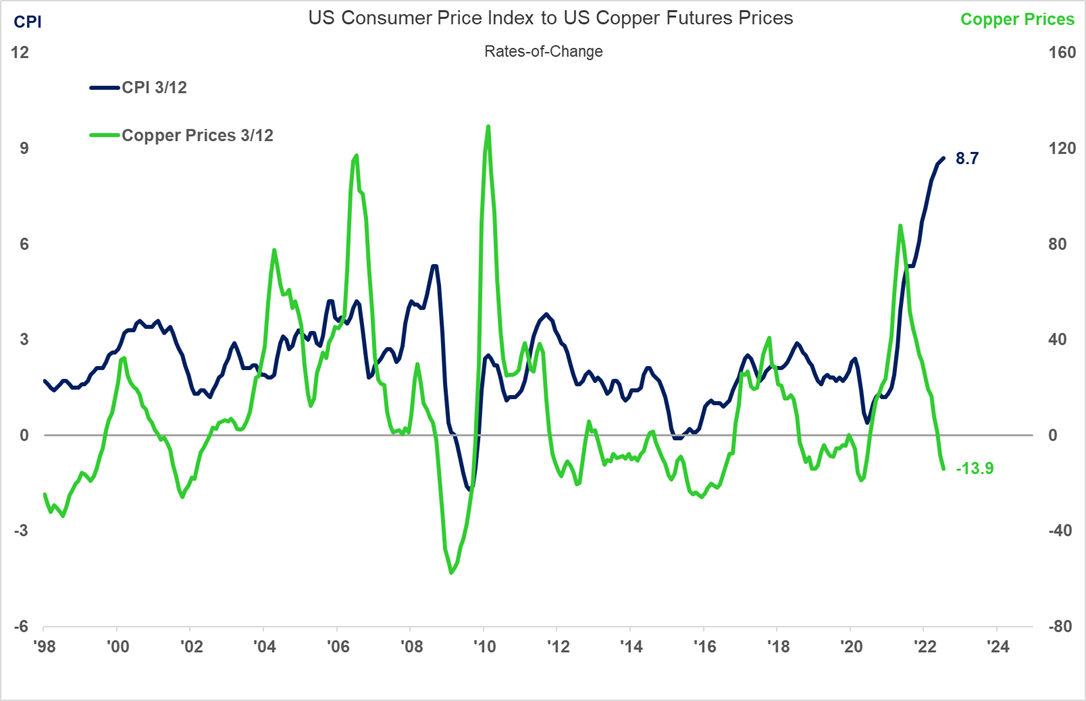

Copper Futures Prices are also clearly indicating an imminent shift to disinflation. As the green line (Copper Futures Prices 3/12) moves lower, it provides a clear signal that the CPI 3/12 will soon be reaching a peak.

Consumers are spending at sustainable levels, and disinflation is on our doorstep, with actual deflation occurring in various commodities. That is not to say that no industries will see any recessionary movement. We are expecting a decline in the housing industry, among others. Still, other industries will slow down in their rate of rise, and others will continue unabated. Negative-sounding headlines aside, the best advice for many is to remain calm and carry on. The best way to do that is to see how your company fits into the business cycle and know what the leading indicators are saying about your trend probabilities. Please head to our website to see more on how to do that.