We are forecasting rise for US Private Sector Employment – our flagship jobs dataset – through at least 2026. We are also expecting that the labor market will remain relatively tight throughout that time.

However, a look at job openings data, which often serves as a leading indicator for employment trends, suggests that the market tightness is not equally intense across all industries.

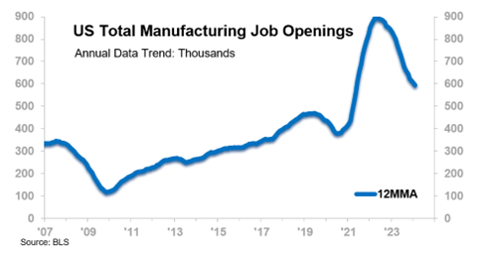

Manufacturing

US Total Manufacturing Job Openings are declining.

- The 12-month moving average (12MMA) has been declining since 1H22.

- At 595,250 as of February, the Manufacturing Job Openings 12MMA was down 33.8% from that post-COVID high (also an all-time high for the data history that goes back to 2001).

- The number of Manufacturing Job Openings is about in line with the post-Great Recession trajectory that was in place until the onset of COVID (straight line on chart).

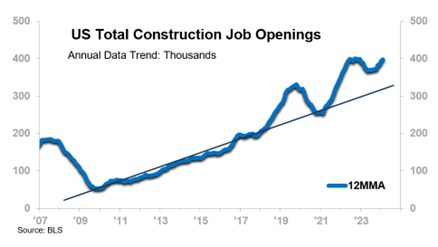

Construction

US Total Construction Job Openings are rising.

- The 12MMA has been rising since June 2023 (one month before the onset of the current rising trend in the US Single-Unit Housing Starts 12MMT).

- At 398,083 as of February, the Construction Job Openings 12MMA was just 0.6% shy of the record high, set in 2H22.

- Construction Job Openings are trending above the post-Great Recession trajectory. Note that the ramp-up took hold before COVID interrupted it.

- Some of this performance is attributable to atypical strength in nonresidential construction, specifically manufacturing construction, amid a federal government push to facilitate renewable energy and scale up domestic semiconductor production.

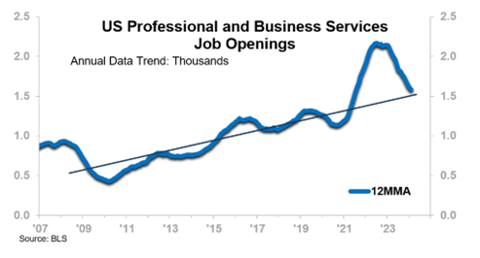

Professional

US Professional and Business Services Job Openings are declining.

- The 12MMA is declining off a mid-2022 record high.

- As of February, the 12MMA was at 1.6 million Job Openings, down 26.9% from the record high.

- Similarly to the manufacturing sector, the number of Professional and Business Services Job Openings is roughly on trend with the post-Great Recession trajectory.

The bottom line for employers is that your difficulty in hiring and retaining employees will depend on your field (and other factors such as your geographic location).

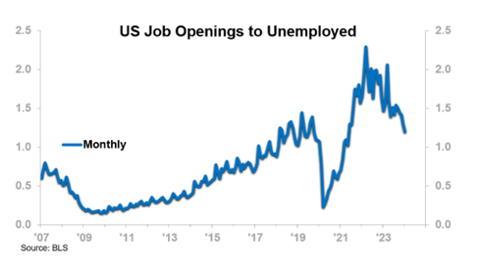

Job Openings vs. Unemployed People

The number of job openings per unemployed person has been generally declining off a 1H22 post-COVID high of 2.3. This ratio, in a sense, serves as a measure of opportunity from the consumer’s perspective; the more job openings relative to unemployed people, the more opportunity for those without a job to get one.

- The ratio is still in the consumer’s favor insofar that there are still more job openings than unemployed people.

- As of February, however, that ratio was down to 1.2.

- The decline in the chart may appear somewhat encouraging to employers who are hoping for some easing in the labor market and less encouraging for those looking for work. For now, the ratio is at the level it was pre-COVID, and many companies considered the labor market relatively tight at that point.

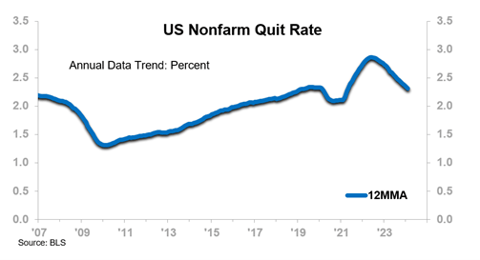

The US Nonfarm Quit Rate (12MMA charted to smooth out seasonality) is exhibiting a similar trend.

- The Quit Rate 12MMA is currently at about the pre-COVID level.

What It Means

The labor market is still tight, but not to the extremes that we saw in 2022. This dynamic will help the consumer stay relatively strong while continuing to be an issue for employers. Ensure your top performers are satisfied and your compensation packages are attractive to prospective employees. Look into automating where possible. This may include “off the floor” administrative tasks via the use of artificial intelligence or other emerging tech.