It can be a challenge to weed through media reports on wages. There are several different sources and ways to look at income-related data. For example, here are some options that news articles may cite:

- Wage Growth

- Gross Earnings

- Inflation-adjusted Earnings

- Real Personal Income

Let’s look at each of them to get the full picture.

Wage Growth vs. Inflation-Adjusted Earnings

Currently, the pace of wage growth is coming down from a 2022 peak. The current slowing growth trend in wages is sometimes presented negatively in the news, and it does reflect a slight softness in the labor market following COVID-induced tightening. However, neither wages nor the labor market is crashing – in fact, the labor market remains relatively tight, and gross earnings themselves are still rising, just at a slower pace.

In the 12 months through February 2025, US Weekly Earnings of Private Sector Workers averaged $1,210 in nominal terms, according to data from the Bureau of Labor Statistics (BLS). This BLS Earnings data is an estimate of wages earned, inclusive of premium pay for overtime, late-shift work, and pay tied to output on an incentive plan. After adjusting for inflation, Earnings in February were 10% higher than average earnings in 2007.[1] In other words, Average Earnings have risen by an amount equivalent to 10% more purchasing power compared to 2007.

To be clear, there have been some periods of time between 2007 and 2024 where Earnings did not keep up with inflation. Most notably, in 2022, Earnings shrank by as much as 2.9% year-over-year on an inflation-adjusted basis – but previous and subsequent rise in Earnings add up to an increase above inflation.

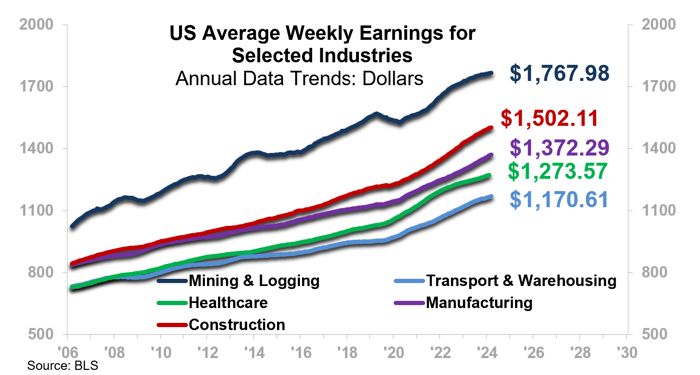

Keep in mind that Earnings trends may diverge by industry. Adjusted for inflation, Average Weekly Earnings in the manufacturing, construction, and transportation and warehousing sectors are outpacing inflation, as evidenced by the positive 12/12 rates-of-change noted on the chart below, but the opposite is true for the mining and logging and healthcare industries. The BLS has additional data that drills down into wages and earnings for supervisory versus non-supervisory roles, which may provide additional insight for your business. If you need help analyzing industry-level trends, reach out to us.

.png?width=700&height=390&name=US%20Average%20Weekly%20Earnings%20of%20Private%20Sector%20Workers%20(deflated).png)

US Real Personal Income

Another income metric reported in the news is US Real Personal Income (excluding current transfer receipts).

- This is an inflation-adjusted number, but it differs from US Average Weekly Earnings in that it includes income from sources other than wages, such as investment income.

- The version presented here does not include transfer receipts such as government benefits like disability, workers' compensation, or unemployment insurance.

- US Real Personal Income is rising – a positive sign for consumers and the macroeconomy – though the pace of ascent is easing. This is the indicator of wages we find best correlates to GDP.

Looking forward, tightness in the labor force given the limited supply of workers still unemployed, elevated corporate profits, and positive macroeconomic leading indicators suggest that US Real Personal Income is likely to stay elevated.

.png?width=700&height=384&name=US%20Real%20Personal%20Income%20(excluding%20current%20transfer%20receipts).png)

Conclusion

Wages are far from being in freefall. Nominal wages are rising, although the pace of rise is easing. Inflation-adjusted data reveals that Private Sector Earnings have risen with a modest premium above inflation going back to at least 2007.

We anticipate that demographic pressures – namely, a lack of younger workers as baby boomers retire – will put further upward pressure on nominal wages. Rising wages will allow consumers to increase their spending, driving retail activity and contributing to “sticky” prices in the coming years. However, this is not without nuance. The cumulative impact of past cycles of inflation has a number of consumers feeling the pinch. Many consumers are likely to be price-conscious this cycle, making it difficult for some businesses to pass on price increases.

Inflationary pressures will also affect markets unevenly, as demographic trends and potential deportations will impact certain industries more than others. Now is the time to evaluate your business’s exposure to labor costs and consider whether capital investments could help mitigate wage-related margin pressures.

_______________________

[1] For this data series from the Current Employment Statistics – National (CES-N) program at the Bureau of Labor Statistics, 2007 is the earliest full year of available data.