In March we discussed the stark regionality of the single-family construction market, with growth in the West and South outstripping the Northeast and Midwest by a large margin.

The multi-family market is also exhibiting regionality, but the trends are different.

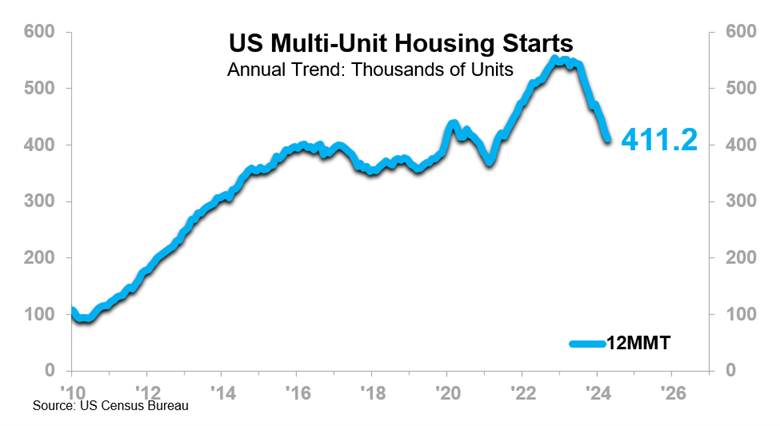

While US Single-Unit Housing Starts are rising, US Multi-Unit Housing Starts are declining.

- The Multi-Unit Starts 12-month moving total (12MMT) nationwide was at 411.2 thousand units in April, down 23.8% from April 2023.

- The Multi-Unit Starts 3/12 rate-of-change is below the 12/12 rate-of-change. This ITR Checking Point™ suggests that the 12/12, and therefore the 12MMT in this case, will likely continue to decline in the near term.

- Multi-Unit Starts have descended to below the February 2020 pre-COVID level (Single-Unit Starts are ascending and currently 11.8% above the pre-COVID level).

On a regional basis, the strength in the single-family market is most apparent in the West and South. In the multi-family market, these regions are less bullish.

- The West Region Multi-Family Housing Unit Building Permits 12MMT is declining, coming in 18.8% below the year-ago level. Furthermore, West Region Permits are also in Phase D, Recession.

- The South Region 12MMT is also declining, down 27.1% from the year-ago level, and in Phase D. The ITR Checking Points are throwing off a negative signal, with the 3/12 below the 12/12 and declining.

Meanwhile, nascent green shoots appear to be forming in the Northeast and Midwest for the multi-family market.

- Northeast Region Permits are down 9.4% from the year-ago level but in Phase A, Recovery, since December, and the Checking Points signal is positive.

- Midwest Permits are in a tentative Phase A, Recovery, trend, and the Checking Points signal is also positive.

The Bad News

The Midwest and Northeast combined account for just a little over a quarter of the nationwide multi-family housing market. From a national perspective, the greater favorability of the trends in the Midwest and Northeast is mitigated, to an extent, by the shallowness of the pool.

However, a company with well-defined competitive advantages and a reasonable market share – or cohesive plan to take it – should be cautiously optimistic in the Midwest and Northeast.

For more granular data, take a look at the latest ITR Advisor™. Every month, we look at some aspect of the economy on a state-by-state basis. This month it is housing.