Superior business strategy results can be realized if you:

- Account for nationwide economic trends

- Consider trends at the regional, state, and city level

- Take the broader demand pull in mind given housing starts are a leading indicator

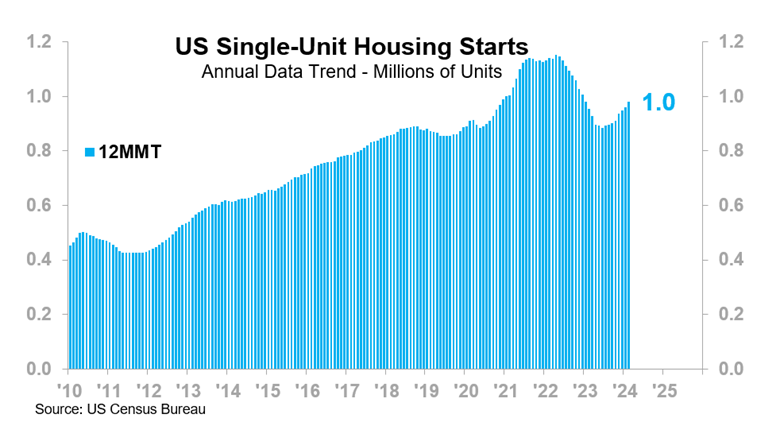

A look at the 12-month moving total for US Single-Unit Housing Starts, a national series, shows relatively robust rise since the June 2023 low point; the 12MMT has increased by approximately 95.0 thousand Starts since the low.

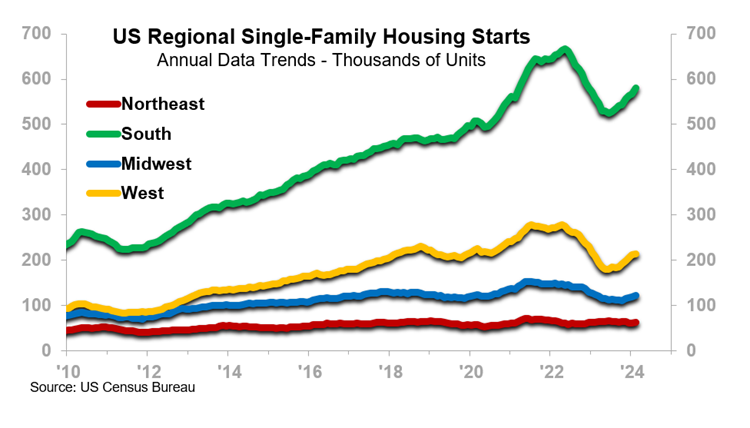

When we dig deeper into the US Census Bureau’s regional housing construction data, we see that the story varies according to geography.

The South and West regions of the US have exhibited the far greater share of growth.

- As of February, the latest month of data, the US South Single-Family Housing Starts 12MMT was up 10.6% – or 6 thousand homes – from the nationwide post-pandemic low point.

- The US West Single-Family Housing Starts 12MMT was up 18.9% from the post-pandemic low, an increase of 2 thousand homes.

- Together, the two regions account for 8 thousand new homes started (12MMT basis) – or 94.5% of the new homes started nationwide – since the post-pandemic low.

The recovery has so far been less impressive in the Midwest and Northeast regions.

- US Midwest Single-Family Housing Starts were up 8.3% from the post-pandemic national low, adding 4 thousand homes during that time.

- The Northeast, meanwhile, has contributed a net loss of 3.6 thousand homes to the national total since June.

The stark opportunity differences, which have been in place since well before COVID, are visible in the next chart.

For businesses associated with homebuilding, the takeaway is that the western and southern regions of the US offer a larger pool of opportunity.

Furthermore, this will apply, to some extent, to more than just homebuilding. US Single-Unit Housing Starts are a key leading indicator for other macroeconomic metrics, such as US Industrial Production, US Real GDP, and (later) nonresidential construction. More homes generally mean more economic activity, and some of that new activity is likely to concentrate where the greater share of new homes is.

If you would like to know more about which areas are likely to see a large share of economic growth in the next several years, ITR Economics can help.