The percentage of overall operating costs that labor accounts for will vary by industry and company, but it is an important component of just about anyone’s cost structure. The availability of labor is an almost universal issue in business today, and the problem will be with us for years to come.

The cost of labor is going to be accelerating higher through the coming year, with a decelerating rate of rise likely in 2024. Businesses must act immediately and work to mitigate the margin squeeze that comes with burgeoning labor costs in an overall disinflationary environment.

The Issue

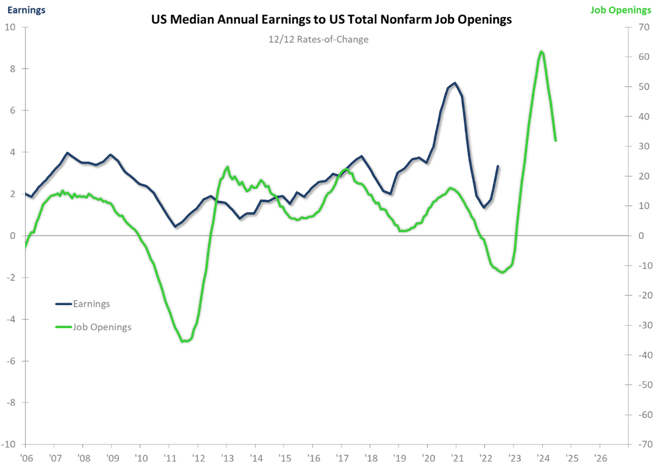

The chart below shows a 3.3% rate of rise in US Median Annual Earnings, and the 12/12 is rising in Phase B, Accelerating Growth. Median Annual Earnings as of June 2022 stand at $54,281, up 5.2% from June of last year (1/12). The US Total Nonfarm Job Openings 12/12, which is shifted forward along the chart’s horizontal axis to account for Job Openings’ leading relationship to Earnings, shows that the Earnings 12/12 rise may last through all of 2023, with a decelerating rate of rise beginning in the early stages of 2024. Note that we should not expect the slowing rate of rise in the US economy to slow the rate of rise for Median Annual Earnings. The takeaway from this is that your labor costs are likely to keep going higher even as disinflation and even some deflation make it more difficult to pass along price increases. Margin squeeze will result as the overall disinflationary environment makes it more difficult for many businesses to increase their prices and pass through the impact of higher labor rates.

To make matters more intense, the increase in labor costs is occurring as the US Nonfarm Productivity Index1 is declining. The Productivity 3MMA has dropped an unprecedentedly steep 2.9% from the December 2021 record high. A productivity decline while labor costs are going up has the potential to place unaware and nonresponsive firms in financial jeopardy, or at least at a disadvantage relative to their more efficient competitors. More efficient producers may be in a position to price their goods/service below those of less efficient competitors and still make a profit in the event of tight market conditions.

Steps to Take

There are two courses of action available to businesses that want to get ahead of the mounting labor costs that will likely characterize the rest of the decade.

- The first is to increase your capital intensity to drive efficiency of your existing labor force. New processes (not just machines) throughout the company, from the operational floor to the corner offices, can increase output and result in a measurable ROI.

- The second course of action would be a merger or acquisition, with the goal of removing operational redundancies in the two (or more) organizations.

A visionary CEO with a strong handle on costs is needed on either path. A hesitating, risk-averse CEO will lose time, which will equate to years of additional costs that will erode margins and weigh down profits.

1US Nonfarm Labor Force Productivity Index, 2012 = 100, not seasonally adjusted. This index compares the amount of goods and services produced (output) with the number of hours it took to produce those goods and services.