A unique combination of pent-up demand, initially depressed price levels, and profound stimulus support (boosting both savings and disposable income) has yielded explosive demand and consumer spending growth in late 2020 and the entirety of 2021. However, these fundamentals are starting to fade, setting us up for a very different consumption environment in 2022.

During the 12 months through September, US Total Retail Sales came in 15.9 % above the same period one year prior; this is the highest annual rate of growth in the history of the dataset, which extends back to the late 1940s. This unprecedented consumption growth has played the primary role in driving inflation and the supply chain and logistics network stress and breakdowns that have been plaguing ITR’s client base this year. The overwhelming demand growth has outstripped the slower-moving supply-side and capacity gains to put us in this situation, and it will likely be cooling demand growth next year that helps return us to something more closely resembling a pre-COVID "normal." In fact, a few key data points indicate that the demand-side normalization is already underway.

First, the aforementioned retail trend is already cooling. On a quarterly basis, Retail Sales growth is steeply decelerating. The quarterly growth rate as of the end of the third quarter has declined to 15.2% – less than half the peak quarterly growth rate of 36.8% set in May 2021 – and has downward-passed the annual growth rate of 15.9%. The latter is a key checking point we monitor at ITR Economics. One may wonder – why is the consumer slowing down? The answer lies in two key trends that are tied to consumer vitality.

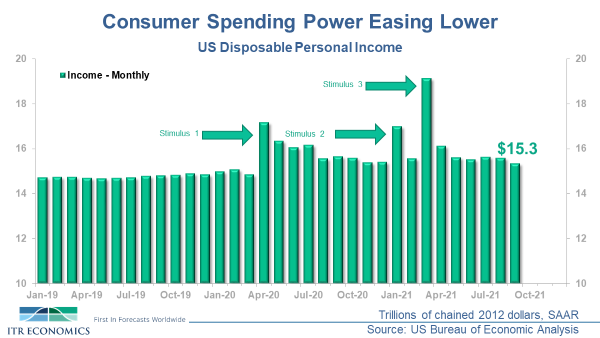

The stimulus-induced sugar high is fading. US Disposable Personal Income stands at $15.3 trillion as of the most recent data, down considerably from the all-time high of $19.1 trillion set in March 2021 with the passage of the American Rescue Plan stimulus package. The good news is that the September Disposable Income figure is still roughly $300 billion higher than the pre-COVID level of $15.0 trillion, set back in February 2020, but the declining trend is quite evident and indicates the high-flying consumption growth of 2021 is likely to decelerate considerably in 2022, in line with ITR’s forecast for Retail Sales next year. On top of falling income levels, we see Personal Savings declining as well:

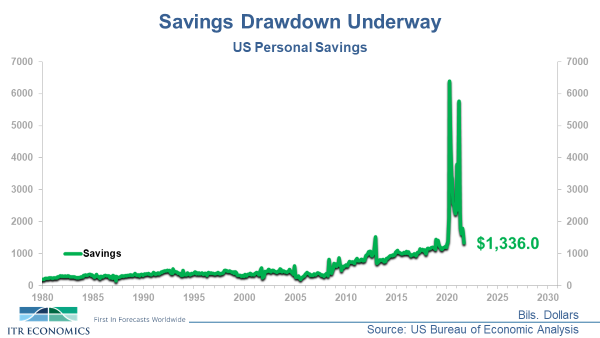

Personal Savings fell to $1.3 trillion in September 2021, down 46.7% from September 2020 and slightly below the February 2020 level observed before COVID-19 shutdowns began to impact the US economy. As you can see in the chart above, much of the stimulus initially flowed directly into savings before filtering gradually into the economy in the form of spending. With elevated consumer spending and rising price levels, the collective US consumer has burned through much of the savings cushion established during the pandemic.

On the road and in our consulting engagements, we have been fielding a common question in recent months: "When and how will supply chain strain and pricing pressures get better?" ITR anticipates that signs of normalization will begin to emerge, gradually, as we move through 2022. It was a very unique set of circumstances that got us to where we are currently, and it is probable we will come back down to earth next year. One of the biggest mistakes a business could make right now is to base its forecasts and 2022 expectations on what is happening today rather than what is coming tomorrow.

Connor Lokar

Senior Forecaster