In the wake of several assaults on Israel in October 2023, Houthi militants have escalated their attacks on ships in and around the Red Sea, along the Yemeni coast, since November. The targets of these attacks include both military and commercial vessels, which has been prompting concerns among businesses and analysts about potential economic repercussions of these events.

- The Red Sea serves as a crucial segment of a major trade corridor connecting Europe, the Middle East, and Asia. Any diversion of ships from this route requires a longer and more expensive journey around the southern tip of Africa.

- With control over parts of Yemen, a country bordering the southern stretch of the Red Sea, the Houthi movement has asserted its influence in the region. Their attacks have targeted ships transporting various cargoes such as cars, oil, and chemicals, among other goods.

- These assaults have been directed at ships flying the flags of many different nations, including Liberia, Norway, Malta, Hong Kong, Singapore, and more.

- At the time of this report, the US and UK had initiated airstrikes against Houthi positions, yet the Houthis were still persistently targeting ships.

What is the Economic Impact?

The attacks are recent enough that any significant economic impact on the US may not yet be reflected in the data, as it typically lags the present by approximately a month. However, based on the current situation, we can draw some conclusions and predictions regarding the probable short-term effects on the US economy:

- Since the attacks are disrupting a trade route connecting Europe, the Middle East, and Asia, their primary impact is felt by US trade partners rather than directly affecting the US itself.

- US businesses have become adept at managing supply chain challenges, particularly following the COVID shutdowns. Many have shifted their focus towards onshoring and near-sourcing, potentially mitigating the direct or indirect effects of the ongoing Red Sea conflict.

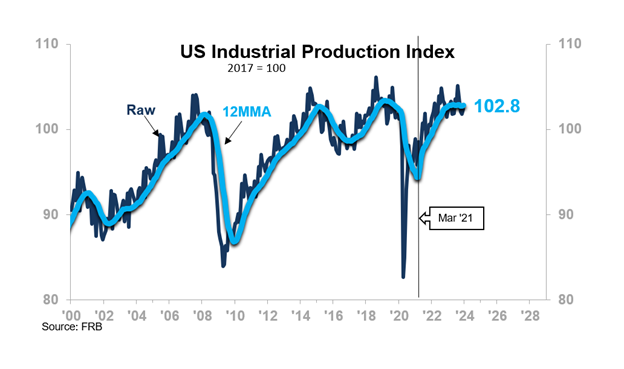

- Notably, a six-day blockade of the Suez Canal and the Red Sea trade route occurred in March 2021 due to a container ship grounding incident. However, this event did not significantly worsen the trend in the New York Fed’s Global Supply Chain Pressure Index, which was already on the rise due to broader global supply chain issues following the COVID shutdowns. Additionally, there was no discernible impact on US GDP or US Industrial Production during that time period.

- While a substantial impact on the overall US macroeconomy appears unlikely at present, certain businesses, especially those with international operations, may encounter challenges and disruptions.

While we recognize and mourn the human cost of geopolitical conflicts, we approach the Red Sea situation from an economically objective standpoint. We believe it warrants careful observation, particularly in the event of any escalation. Adopting a cautious approach and waiting for data before drawing conclusions appears to be the most sensible course of action. Furthermore, over the long-term, conflicts like this one are likely to spur increased efforts in onshoring and near-sourcing initiatives.