Near sourcing and onshoring trends are underway in the US, both as insurance against any future COVID-esque supply chain difficulties and as part of a broader shift away from globalism and toward nationalism. Shortening supply chains and ensuring supply vitality are imperatives as global relations and international relationships fray.

In some cases, the near sourcing and onshoring trend is significant enough to be clearly visible in major datasets:

- In the 10 years leading up to the COVID shutdowns, US Private Manufacturing Construction increased 48.2%.

- However, Manufacturing Construction has more than doubled since February 2020, the last month before the COVID shutdowns hit the US economy. This is a 104.8% increase in a little less than four years.

This increase was not completely business-driven; the government was a key decision maker in increasing a certain subsegment of manufacturing in the US. The US Science and CHIPS Act of 2022 provides, depending on the source, approximately $280 billion to encourage and facilitate the manufacture of semiconductors in the US.

- Since the legislation’s passage in August 2022 – a little more than one year ago – Manufacturing Construction has increased 63.2%

Technology companies have announced significant investments in semiconductor manufacturing both leading up to and after the passage of the legislation.

- These include Samsung, Texas Instruments, TSMC, Wolfspeed, Micron Technology, and more.

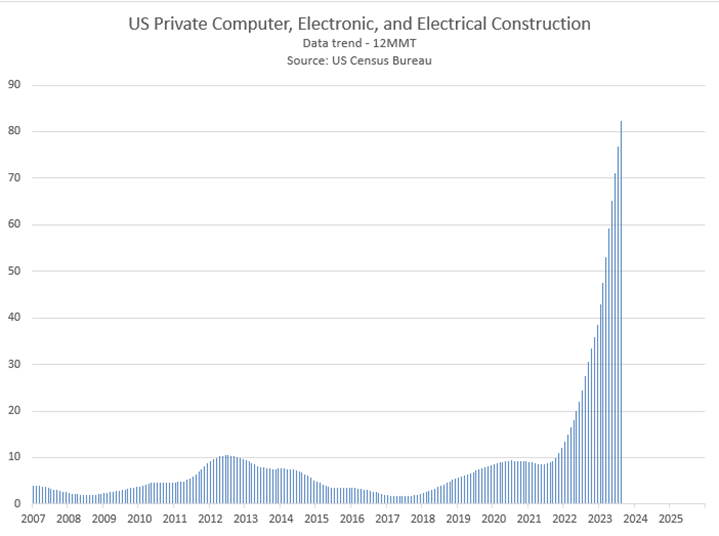

US Private Computer, Electronic, and Electrical Construction is a component of US Private Manufacturing Construction that includes the construction of facilities involved in semiconductor manufacturing. The chart depicts the recent spending growth in this construction subsegment. The spending is measured in billions of dollars:

When the government makes certain benefits available for companies in specific markets, we call that “picking winners.” That is going on here to some extent, but it should also be noted that there are other factors involved:

- Much of this is a reaction to the post-COVID-shutdown semiconductor chip shortages, which crippled the US auto manufacturing industry and caused other problems.

- It is also part of a US effort to be less dependent on overseas players.

- Not all of the rise is attributable to semiconductor-related projects. US Private Computer, Electronic, and Electrical Construction also includes construction spending related to electrical equipment manufacturing.

What This Means

Understand that certain sectors of the economy can be booming even while others are stagnating.

- Rise in US Private Manufacturing Construction at this point in the business cycle is typical.

- Rise in Manufacturing Construction historically lags rise in the greater US economy; Construction is still running on the upswing that has now dissipated for US Industrial Production.

- The steepness of rise in Manufacturing Construction – which stems from the very steep rise in Computer, Electronic, and Electrical Construction – is not typical.

- This rise is driven by a combination of economic forces, government stimulus, and societal trends.

- These rising trends will eventually come to an end.

- Even amid the steep rise, Computer, Electronic, and Electrical Construction is in Phase C, Slowing Growth.

- Overall Manufacturing Construction is on the cusp of Phase C.

Would you like to know more about a certain segment of the economy, such as when to prepare for diminishing opportunities followed by when to ready your processes for rise ahead? We can help you see the future well before your competitors.