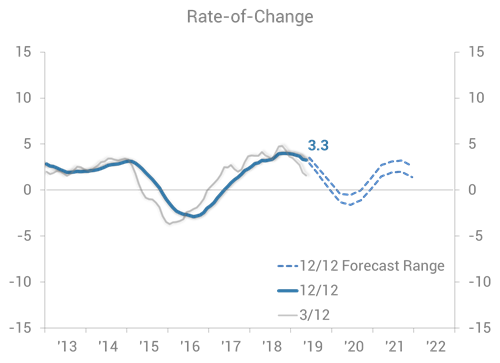

The US economy, as measured by Industrial Production, is slowing down. Industrial Production is a great benchmark for most industries and most companies. Knowing when that 12/12 rate-of-change is going to reach a low or establish a high gives you a strategic advantage over your competitors and an opportunity to gain market share.

Leading indicators are the key to seeing the next turn in the economy. We are currently experiencing decelerating rise (for the most part; some industries and companies are already in decline) as evidenced by 12/12 decline in the US Industrial Production Index on the chart below. That same 12/12 decline is evident in most industries and perhaps in your own rate-of-change.

US Industrial Production

The ITR Retail Sales Leading Indicator™ is the furthest-looking of our indicators. The proprietary indicator looks out an incredibly long 18 months (median timing at lows), and it is currently rising off a January 2019 low. January 2019 plus 18 months puts the upcoming Retail Sales 12/12 low in July 2020.

Retail Sales are an extremely important component of our economy as they provide the demand-pull for consumer goods and, indirectly, the demand that will encourage capital investment by businesses. Our early-turning indicator suggests a general increase in the US economy in the second half of 2020. Our leading indicator decline until January 2019 also means cyclical decline will characterize the overall economy into next year.

Seeing around the corner must be followed by planning now for what you will need to make happen once we get through the upcoming low.

- Cash management is never far from the top of the list. While capital expenditures are often a must, this is an opportune time to see where cash savings can be had. A friend of mine just told me that his business cut their outside advertising firm, brought the work in-house, and saved almost $4 million a year. He is also achieving better results. Now can be a great time to bring some expertise in-house and see improved output. Obviously, this cannot be done with all consulting and outside services, and we would be quick to add that it is never a good idea to drop your economic consulting firm!

- Now is also the time to prepare for the accelerating rise projected for Industrial Production in the latter stages of 2020 and in 2021. Order that machine that will enhance your operation, be it some form of automation or simply a newer or faster production machine that will render higher quality output. Lead times for capital equipment will vary, but lead time for delivery, installation, and training can easily consume the next three quarters. It may be a CRM or ERP system that needs to be purchased and implemented. Either can consume at least several quarters of your time, which is tough enough, and it becomes unbearable if you are in Phase B, Accelerating Growth. Pull the trigger on the investment now and be ready for increased activity around the corner.

- Have your marketing team (newly in-house perhaps?) get started on a market analysis of what your clients are going to want and need as the economy picks up speed next year. What product is offered by your competitors that you have not taken the time to develop or have been ignoring because you were too busy with today? Determine how your clients will want to receive your product or service and start building it now.

Be Careful

We use a system of leading indicators; we never use just one. Other leading indicators in our system are expected to establish verifiable troughs over the next few months. Watch these indicators closely and you will gain immeasurable confidence in acting today to prepare for tomorrow. And, most important of all, determine how your own rates-of-change relate to these indicators. We can help you with that, too.

Alan Beaulieu

President