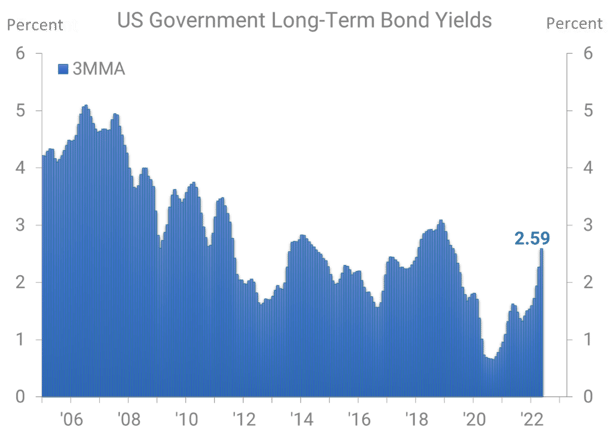

We’ve all heard rates are going up. The chart shows US Government Long-Term Bond Yields, a good general gauge of interest rates. We are using the three-month moving average (3MMA) to smooth out the volatility in the daily data.

At 2.59%, the Bond Yields 3MMA through May came in a substantial 97 basis points above the year-ago level and 88 basis points above the February 2020 pre-pandemic level.

Still, from a historical perspective – and as seen in the chart – 2.59% is not particularly high. However, the Federal Reserve Board, which issues the fed funds rate and sets the tone for general interest rates nationwide, has indicated an amenability to further rate hikes. Our forecast anticipates rise for Bond Yields – and interest rates – through at least the first quarter of 2023.

If this insight seems double-edged, that's because it is. On the one hand, rates are noticeably higher (but not high from a historical perspective). On the other, they won't likely be going lower anytime soon.

Economic Factors and Time

These relatively higher rates should not necessarily discourage borrowing. The question is whether paying that interest will be worth it. In short: do you anticipate sufficient future demand to support a loan-funded expansion of your business?

ITR Economics can offer accurate forecasts for both the macroeconomy and your specific markets. From there you can assess whether the couple of business cycles between now and the onset of the upcoming Great Depression, which we have forecasted for around 2030, will offer sufficient economic growth to allow for a worthwhile return on your investment.

Labor and Efficiency

While "growing the business" via expanded capacity is a popular objective for business investment, increased efficiency is also a worthy goal. ITR Economics expects the labor market will remain tight – with associated high costs – for at least the next few years.

Investments that will ultimately lead to increased labor needs, then, should be scrutinized extra carefully. Meanwhile, an investment that increases your enterprise's efficiency or adds automation will help you address a key pain point.

Inflation

Consider the items or processes you wish to finance. Like nearly everything else at the moment, the price is likely relatively high. Is it likely to stay at that level, increase, or decline over the next year? If you can avoid it, you don't want to purchase something on borrowed cash only to later watch the price go down as you make interest payments.

Moving Pieces

There are many factors in flux at the moment, and many of them require accurate forecasting to effectively gauge. Through our various ITR Economics consulting programs, our expert economists can arm you with reliable foresight so you can feel more confident in your course of action. Please contact us for more information.