A lot of folks think perception is reality, and to a certain extent I agree. Perception can often become your reality, even if it is not in alignment with what is happening on the ground. Perception, and expectation, is particularly important when it comes to the economy and how you approach decision-making for the future. If your personal perceptions and resulting decisions are misaligned with the upcoming economic realities, your business will not be in the best position to succeed.

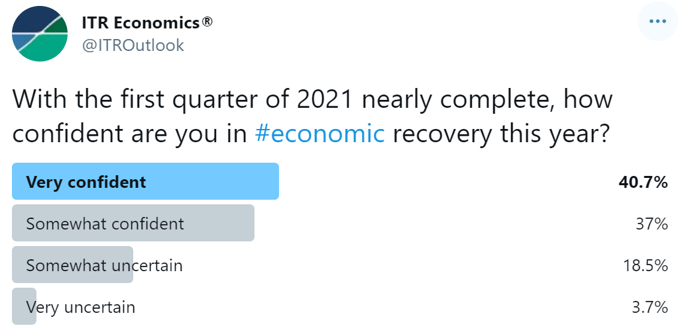

Along this train of thought, I thought the recent poll question on our ITR Twitter account was particularly interesting:

In this poll, 40.7% of respondents indicated they were “very confident” in the upcoming economic recovery and rebound during the remainder of 2021. This excites me! This is precisely in line with ITR’s forecast expectations, and I expect that executives carrying this perception of the present and expectation for the future will leverage that into smart, proactive decisions that will prepare their organizations for rising activity moving forward.

Less exciting for me was that nearly 60% of respondents were, at best, mildly confident in the upcoming recovery, if not outright uncertain. For this majority, their perception will be paralyzing, likely yielding delayed and reactive decision-making later this year, when the economic realities on the ground forcefully change their perception.

ITR leverages market benchmarks and leading indicators to set our perception and expectations for the economic future. These predictive data points are ultimately objective, excluding emotion, fear, and subjectivity from the equation. They allow us to bury outdated perceptions colored by the past and instead build our expectation based on what is and what will be, not what was. At this point in time, our leading indicator dashboard is definitive, and it is calling for rising positive momentum in the economy moving forward.

If you find yourself aligned with the near 60% of respondents that are not yet confident in this year’s economic rebound, you need to ask yourself why. There could be perfectly justified reasons to be more apprehensive about the year ahead. Your business may serve lagging markets such as nonresidential construction, for example, or a market that has been particularly battered by COVID-19, such as aerospace. Recovery timelines for such markets will not sync perfectly with the US macroeconomic rebound this year.

If you don’t fall into those categories, you may need a new set of tools to override outdated perceptions and expectations. We go through this process daily with our consulting clients, showing them how their business performs relative to the economy and analyzing their leading indicators. This helps properly align perceptions and decision-making in order to launch the most profitable attack on what is coming next in the business cycle, not what already happened.

Your biggest fear for 2021 should not be that demand won't be there for your businesses. Your biggest fear should be that your business will not be prepared when that demand shows up. Leveraging a customized leading indicator program can help you zero in on when your business can expect demand to arrive and how long it will continue to increase. In other words, using data is the surest way to align your perception with the coming reality.

Connor Lokar

Senior Forecaster