Here we are in the beginning of a new decade. There is a lot to ponder about the future. Where is this decade going to take us? Where should I invest my money? Which markets are going to be the winners? Which markets are going to be the losers?

Here is a great quote by St. Francis of Assisi: Start by doing what is necessary; then do what is possible; and suddenly you are doing the impossible.

Think about that for a second.

Understanding the state of the economy is a necessary part of business. Imagine if you knew that the economy was going flourish next year. I assume you would make different business decisions than you would if you were walking blind into 2021. Given the economic information we will provide during our Retail Sales webinar this month, you can take advantage of all the possibilities that are offered to you. With that, you and your business can do the impossible: You can make strategic and selective business decisions, perhaps contrary to what your competitors feel is possible, and enable your company to prosper in the coming years.

At the time of this writing, the retail industry is demonstrating a small rebound, partially driven by recent rise in US Credit performance. While this is momentarily comforting news, still know that 2020 will exhibit the softest pace of rise in quite some time. Next year will be stronger. Treat this year as a preparation period for what’s to come in 2021. Get everything sorted out now, rather than later, to reap the benefits of a prospering retail industry in 2021.

Now let’s get into the weeds. As expected, we saw record-high levels from US Retail Sales in 2019. Over the entirety of last year, $6.24 trillion was spent on retail. That makes sense given rising population and inflation trends in the US. However, it does not mean the economy is prospering. This will impact consumer optimism and spur individuals to become more risk averse during the next couple quarters.

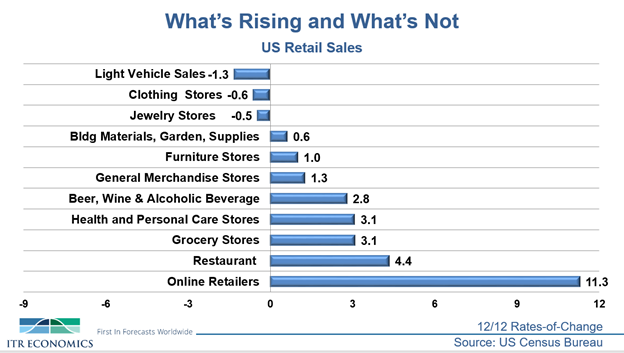

Knowing where to invest your money is crucial. There are segments of retail that are flourishing while others are not. The below chart shows the current growth trends in select markets. Clearly, the winner is the e-commerce industry. The “Amazon impact” is paving a new way to do business. Ensure you are investing in your internet presence.

In contrast, US Light Vehicle Sales are contracting, and during a time when many other industries are still expanding year over year. Inventories in this market are building, which suggests dealerships could be facing challenges with an overabundance of vehicles on their lots. Production in the market is also down, and standards for loan qualification seem to be getting lower and lower. Auto loan delinquencies are above the 10-year average. These numbers are somewhat concerning, and ITR is keeping a close watch on these trends.

For more detailed trends in the US retail sector, join us for our February 2020 Retail Sales webinar. We will take a deep dive into the movements in several markets and provide intel on how you can properly take advantage of these trends!