There are different pictures to paint for the retail industry in 2019, depending on the sector you’re looking at. While some outlooks are sunnier than others, the overarching theme is that the consumer is starting to retreat. We’re seeing the red flags pop up across the board, giving us foresight to the retail-sector slowdown that is to come this year. If you don’t believe us, the proof is in the pudding:

1. 2018's 2Q-to-3Q Retail Sales performance was the worst in six years. (December data has not yet been released due to the government shutdown.)

2. Consumer savings as a percentage of disposable personal income declined for the majority of 2018.

3. Consumer Confidence is waning; this metric has been in business-cycle decline for the past year.

4. Even E-Commerce Retail Sales, which have stolen significant market share from the brick-and-mortar stores, are in a slowing pattern.

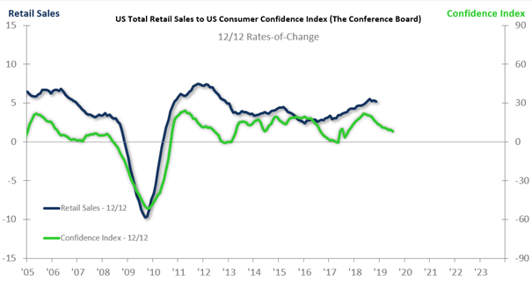

The below chart shows the business-cycle relationship between US Retail Sales and the Conference Board's US Consumer Confidence Index, which was mentioned in the third bullet above. Notice that the green line (Consumer Confidence) extends further to the right than the blue line (US Retail Sales). That’s because Consumer Confidence serves as a leading indicator to the US retail sector; trends in Consumer Confidence lead trends in the retail sector by just over two quarters.

This gives us great predictive insight into the direction of the blue line, or US Retail Sales, as we head into the future, corroborating our expectation that the US retail sector will demonstrate a slowdown as we move through 2019 and into 2020. Consumer Confidence is just one of the many leading indicators that support our outlook for slowing growth in the US retail sector this year.

Do not lose sight of the fact that Retail Sales are also typically measured in US dollars. Therefore, any inflationary pressures will have an effect on the retail sector. Consumer price growth currently stands at 1.9%, which is just shy of the 2.0% inflation barometer deemed healthy by the US. Softer prices compared to last year may also be a reason why the US Federal Reserve recently became more relaxed in its interest rate expectations for this year.

The above is just scraping the surface of what we’ll delve into during the February Retail Sales webinar, which will provide you with the proper ammunition to deal with a slowing economy this year.

Catherine Putney

Economist