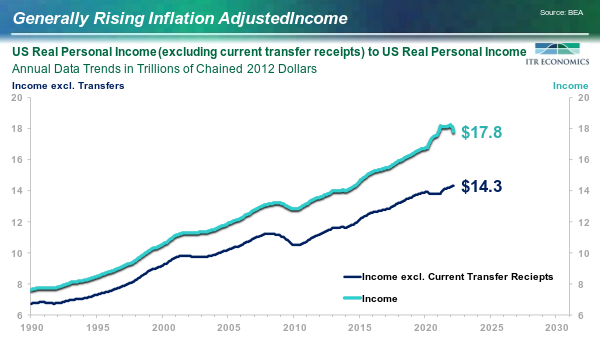

This is either a glass-half-full or glass-half-empty moment as you look at the chart below. How you perceive the trends on the chart likely says a lot about your expectations. You could focus on the upper (thicker) line and see that Personal Income (real means adjusted for inflation) surged during COVID and is now down from that elevated level. The decline in Real Personal Income could be a harbinger of ill tidings for retail sales and therefore the broader economy.

Three factors should be considered if you are going down that road.

- The level of Real Personal Income is still well above pre-COVID levels.

- The current status of Real Personal Income is essentially on trend relative to the pre-COVID trend.

- The surge (and subsequent decline) was caused by the overwhelming amount of stimulus dollars supplied to individuals.

It is likely that the Real Personal Income trend will be sluggish at best in the second quarter as the normalization of transfer payments (beyond the stimulus) becomes the sustaining feature.

The lower trend line is Real Personal Income excluding transfer payments. No stimulus or other government largess is involved in the lower trend (thinner line). The income trend that excludes direct government involvement is positive. Observations on the Real Personal Income trend sans government involvement:

- The current value is higher than pre-COVID. Adjusted for inflation, people are generally making more than before the COVID recession.

- Point #1 means spending power is generally “up.”

- It is important to note that 1Q22 came in virtually flat relative to 4Q21.

- A surge in inflation tends to lead wage increase, so the recent flatness is not surprising.

Our forecast suggests that incomes will remain relatively soft in 2Q22 after adjusting for inflation. This likely ties in with the projected deceleration in retail sales (both adjusted for inflation and not adjusted for inflation). Our forecast also projects rising Real Personal Income Excluding Transfer Payments in the second half of 2022 and the first quarter of 2023. Applied to the probability of a lessening of supply chain pressures (alternative sourcing, slowing world growth, empty containers making their way back to Asia, alternative sourcing for neon, etc.), the improvement in inflation-adjusted incomes suggests we are on track for the projected re-acceleration of the US economy post mid-2023.