Despite the recent announcement of an abysmal US GDP number for the second quarter, which saw the three-month moving average for this broad-based measure of economic activity fall to the lowest level in over five years, we are maintaining our forecast that GDP will begin recovering in the third quarter of this year. Interpreting the GDP decline, and its implications, isn’t always an easy task, so we provided some guidance on how to do it properly in a recent TrendsTalk episode.

Our forecast for the US economy, and the likelihood and profile of the recovery, reflects three distinct areas of analysis:

- COVID-19 Trends

- Leading Indicators of Economic Activity

- Timing and Magnitude of the Stimulus

COVID-19 Trends

We’ve tracked the rise in cases, hospitalizations, and deaths over the past few months, but so far there is no evidence that these developments are resulting in the same kind of stay-at-home orders and industry- and region-wide shutdowns that occurred in late March and throughout April. While re-closures of bars, restaurants, and gyms have occurred, they have not spread to the broader economy. This is what matters from an economic perspective. Although the downside risks are there, we do not currently see a more widespread shutdown of the US economy as likely.

Leading Indicator Input

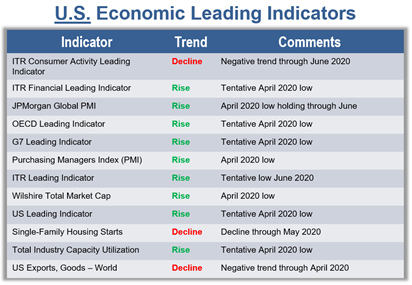

As recently as June, most of our headline leading indicators for the macroeconomy were in declining trends. Now, nine of the top dozen leading indicators are in rising trends, with most ascending from April 2020 lows. This is an encouraging sign that the economy is starting to thaw and bodes well for our expectation that the green shoots of recovery will grow into something more meaningful in the second half of this year. We will continue to keep you abreast of the latest developments in the leading indicators through the ITR Trends Report™.

Stimulus Impact

Trillions of dollars of stimulus funds have been allocated by Congress to mitigate the worst effects of the black-swan driven recession in which we have found ourselves. Congress is further deliberating the next phase of stimuli designed to help bridge the economic ravine for both consumers and businesses this year. However, it takes time for the stimulus money to work through the economic system. Our analysis of previous government stimuli suggests the bulk of the support manifests itself at least one to two quarters after the money is allocated. This indicates that there is a substantial amount of reinforcement that will prop up the economy in the second half of 2020 and beyond.

Based on our analysis, we developed a list of key "stakes in the ground" that we watch every month to corroborate that the recovery remains on track. They include:

- Governors not re-shutting down their states and the federal government not shutting down the country or otherwise hindering the recovery.

- At least five of the leading indicators on our dashboard remaining in “green” rising trends as of the end of September. This statistically significant number will corroborate that our recovery expectations remain on target.

- Key metrics that reflect the health of the US consumer – such as Retail Sales and Single-Family Housing Starts – persisting in supporting the recovery. We need the 3/12 (the quarter-over-quarter rates-of-change) for both series to progress through Phase A , Recovery, in the second half of this year.

The stakes in the ground outlined above will help us track the economic recovery in the coming weeks and months. We hope you will track them with us. Please reach out to us if you would like to discuss the latest economic developments. We can help you better understand their implications for the most important part of the economy – your business.