You will be better prepared for the increase in business

- Be better prepared than your competition, which could lead to increased market share

- Have time to make measured, tactical decisions about maximizing profits in the ascent

- Don’t waste time and energy that comes with focusing on the “noise”

You can improve your cash flow and make strategic decisions to extend your rising trend

- Decide to leverage the future, and leverage now rather than when rates are higher

- Focus on the more profitable aspects of your product/service mix

- Hedge against the coming rising trend in input prices

You can lead with insight and foresight and confidence

- See past the noise and hysteria

- Know how your business relates to the general economy and your specific markets

- Understand which leading indicators matter

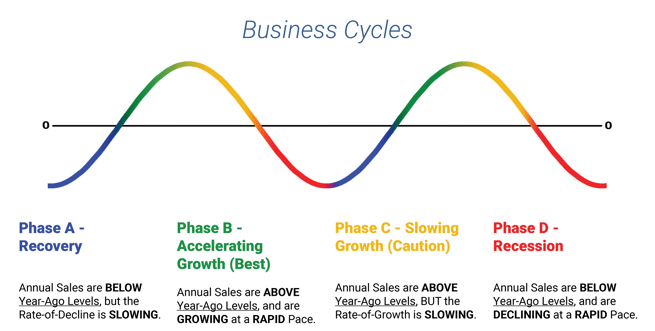

For a firm, the business cycle can come in three forms. One is the standard four-phase cycle you see depicted below. However, mature businesses may not experience Phase B (accelerating growth) and C (slowing growth) but instead spend the final years of their life cycle in Phases A and D. On the other end of the spectrum, companies may go through a period of vitality where they don’t experience Phase D (recession) and A (recovery) but simply vacillate between Phase B and Phase C. This last scenario is why we invest so much time speaking about strategically preparing for 2022–2023. We want you to make sure your firm is one that goes from an elongated Phase C into the next Phase B. But that is fodder for a future day.

What follows is for firms that have experienced enough of a period of weakness from the current business cycle that they are seeking the next Phase A (recovery).

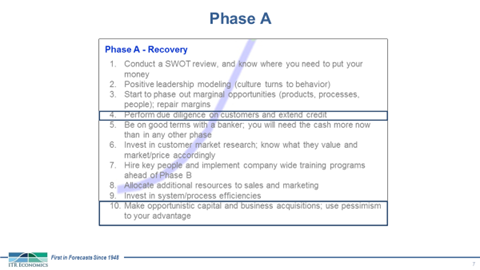

The preponderance of leading indicators makes it clear to us that the next Phase A for most businesses will occur in 2020. Some will experience it fairly early on. Other businesses that tend to lag the general economy may not experience Phase A until 2021. If you find yourself currently in Phase D (recession), you should be carefully monitoring your 3/12 rate-of-change and the leading indicators. Doing so will let you “see” when the shift to Phase A is coming. In the interim, look at the Management Objectives™ below. These are the tactical items we think you should be contemplating regarding your coming Phase A to maximize the upside of the next business cycle.

I was recently in a 90-minute meeting with next-gen leaders. It was fantastic. These people are being groomed to ascend into increasing positions of responsibility. It showed me that as much as ITR Economics discusses the Management Objectives, there is a generation coming into their own that will run our businesses that are not well versed in the business cycle and how to manage for prosperity through the cycle. Share this blog and the Management Objectives with your next-gen leaders. There is no reason they should have to learn the hard way.

Brian Beaulieu

CEO