Pilots, sailors, and hikers all know the importance of an accurate compass at all times, and especially when darkness descends and clouds obscure the moon and stars. I remember an especially dark night when I was in college – we were doing some orienteering work in woods we had never been in before. There were no discernible landmarks in the darkness and no roads, only the goal of getting safely to three waypoints. The adventure was challenging, and fun, and it would have been impossible without a good compass. That device provided the directional accuracy needed to safely get to where we needed to be. At ITR Economics, we strive to be that accurate compass that guides businesses safely through the darkness to the next waypoint. We do that through our forecast accuracy.

Forecast accuracy is extremely important to all of us at ITR Economics. We hold ourselves accountable to our clients and to show how well the forecasts did or did not do. We supply the same list every year in our keynote addresses, and we do an accuracy assessment on client-specific forecasts, as well. We know that one of the best ways to become a trusted advisor is to provide trustworthy information.

I remember a keynote presentation I did in 2022; the hardest part was convincing the attendees that we were not in a macroeconomic recession and not about to enter one. Many in the audience were absolutely convinced that we were either already in a recession or about to step off the ledge and into the abyss. It is not hard to understand why people feel that way given pronouncements from the media and the way those pronouncements influence people's feelings. Those feelings become perceptions, which become the accepted “reality.” ITR Economics cuts through the noise and examines an objective reality, which, along with our time-proven methodology, drives our forecast accuracy. Businesses have come to trust that objectivity and methodology and can safely, confidently, and successfully, navigate through the woods.

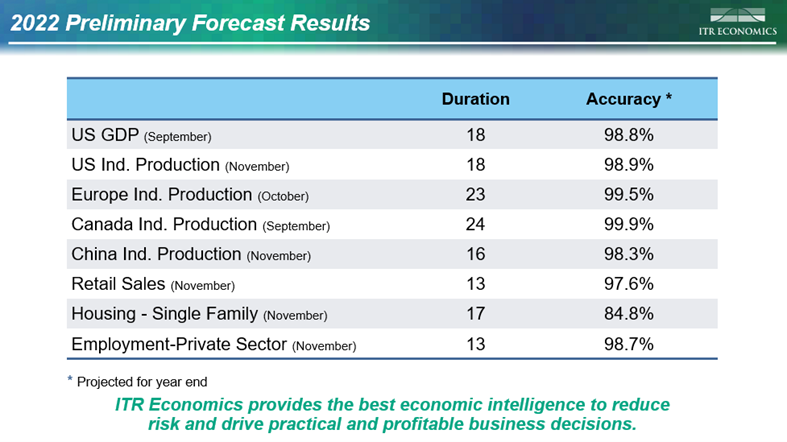

Our preliminary accuracy results for 2022 are immediately below. The Duration column shows how many months the forecast was in place. The Accuracy computation uses a 12-month moving total or average comparison and calculates the deviation from the forecast.

We are very pleased with the duration and the accuracy of seven of the eight items listed. For instance, with data available through June 2021 we forecasted the year-end-2022 US Industrial Production Index with an accuracy of 98.9%. Despite the noise, uncertainties, political discussions, inflation, rising interest rates, war in Ukraine, concerns over food and oil, and significant COVID-related uncertainty in China, the forecast was accurate. We are pleased with the results of all line items except Single-Family Housing Starts. An accuracy rate of 84.8% is not acceptable to ITR Economics.

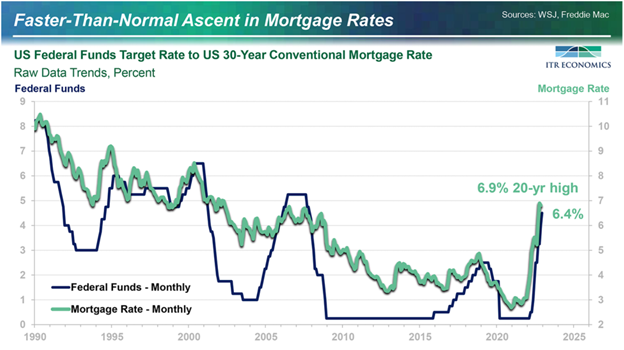

We know what happened, and we are not sure what we could have done differently. Please let me explain. There were two unforeseen occurrences that combined to produce the unacceptable result. Two unknowable events that are not part of our underlying economic theory nor subject to our meticulous math-driven methodology. The first event was not the fact that the Federal Reserve Board raised the federal funds target rate, but rather the magnitude of the rise over a brief period of time. We had planned on some rise, but not what we would assess as an excessive overreaction based on the past 40 years.

The second event was the dramatic increase in the 30-year Conventional Mortgage Rate (see the chart below).

The chart shows the last three times the Fed increased the fed funds rate, and in those prior occurrences the mortgage rate moved higher at a noticeably more modest pace in absolute terms and relative to the federal funds rate. Although we are showing you the last three occurrences, we studied the last eight inverted yield curve situations. This latest occurrence saw mortgage rates spike from 2.68% in December 2020 to 6.9% in November 2022. The rate of rise was unprecedentedly steep, and the rise persisted eight months longer than the typical rise. The mortgage rate increase rendered homes unaffordable to would-be homebuyers to a much greater extent than higher prices did (per our analysis, by a 2:1 ratio). Builders and investors naturally pulled back in the face of the rapid decline in demand. We were planning on normal behavior, and we were wrong. There are encouraging inputs suggesting a late-2023 end to the recession in Single-Family Housing Starts. We will be watching these inputs carefully to make sure the current forecast remains intact.