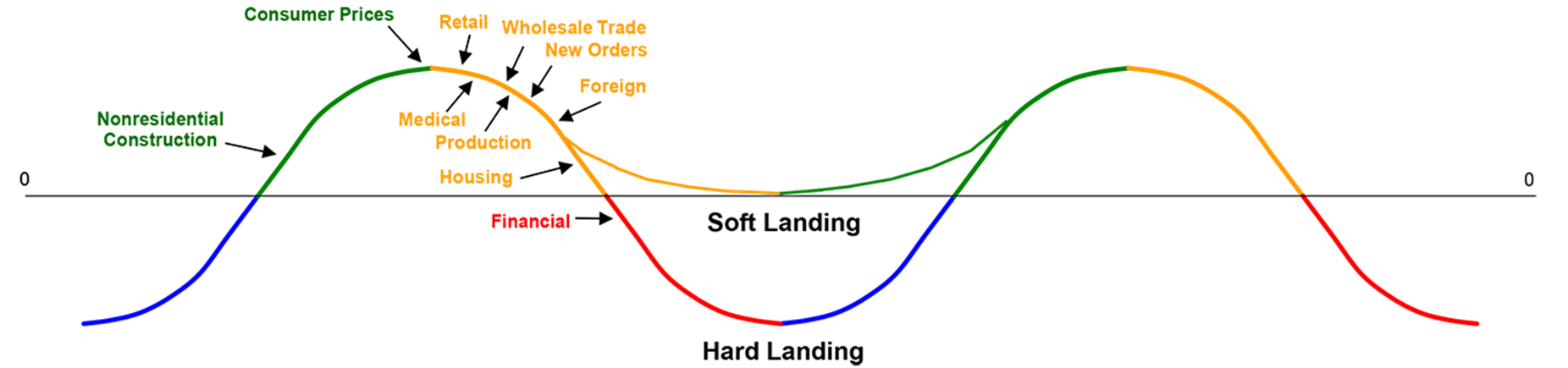

Thanks to our accurate forecasts and analysis, we know that US Industrial Production is currently in Phase C, Slowing Growth, in the business cycle, with a soft landing around the corner. Forecasts for key macroeconomic metrics like US Industrial Production give us insight into where the US economy as a whole is headed, but it is important to remember that not all industries will have the same cycle and timing. This means that while US Industrial Production is in Phase C, other key Leading Indicators could be exhibiting stronger growth or, conversely, decline.

Where Is My Industry in the Business Cycle?

With our Trends 10 insights, you can clearly see where some of the largest industries are in the business cycle, and where they are headed next.

ITR Economics Trends 10 Report

Chart published November 9, 2022

Our Trends 10 summary provides a dynamic look at the economy, as each major segment of the economy is shown in terms of where it is in the business cycle. When looking at the Trends 10 report, you can see that: the majority of industries are in Phase C, Slowing Growth; Nonresidential Construction and Consumer Prices are in Phase B, Accelerating Growth; and Financial is in Phase D, Recession.

With this chart, the best way to fully understand how each major segment goes through the business cycle is by thinking of each of the segments as a railcar on a train. While the order of cars on the train can vary slightly, Housing is typically one of the first industries to move through a high or low period, making it a leading indicator to the industries – or railcars – that follow it.

When a leading indicator such as Housing makes a move, it helps give us a clear forward view for other segments such as Retail or Nonresidential Construction. This forward view helps businesses in the industries farther back in the train prepare for the change in cyclical momentum before it happens.

How Does This Help You Plan Ahead?

By utilizing tools like our Trends Report™, you can know exactly which railcar your industry is on the train, where your industry lies in the business cycle, and which business cycle phase is coming next for each segment.

[ Further Reading: How Can the Trends Report Help My Business Plan for the Future? ]

However, while it’s good to be looking a full business cycle phase ahead, it’s best to look two business cycles ahead. Each phase of the business cycle has Management Objectives™ that provide actionable advice, whether you are in a recession phase or experiencing tremendous growth.

By taking this extra step of looking farther into the future of your industry, you can not only help ease the transition between business cycle phases for your team, but you can also fully capitalize on these Management Objectives and help your business be more proactive rather than reactive.

For example, it is much easier to plan for an upcoming recession phase when you are in Phase B, Accelerating Growth, than it is when your growth is already slowing.

With the business cycle and Trends 10 insights, you can see far into your company’s future with a great deal of accuracy. If you need more help fully implementing ITR Economics’ methodology into your strategic planning, be sure to contact us today!