All year long, ITR Economics has been helping businesses prepare for the upcoming recession that will begin late this year and last through 2024. As business leaders navigate their companies through the ups and downs of the economy, they may find it helpful to apply the lessons of past experiences to what will come in the future. To help you gain a better understanding of the upcoming recession next year, we put together a comparison: the 2020 COVID-19 recession vs. the 2024 recession.

2020 Recession During the COVID-19 Recession

A few years prior to the COVID-19 pandemic, ITR Economics was projecting a downturn in the economy for the 2019–2020 business cycle. Of course, no one could have predicted that a pandemic would take place and have such an overwhelming impact on the world. So, COVID exacerbated the economic downturn.

While the 2020 recession was not as severe as the Great Recession of 2008–2009, there was a much sharper downturn in 2020 than in 2008, and many businesses struggled to stay afloat.

It took a long time for the US economy to bounce back during the Great Recession. However, following the 2020 downturn, the economy bounced back just as fast as it had declined.

This was due in part to consumers; retail sales were performing well at this time, with many Americans receiving stimulus checks from the government. While people were staying home, many began purchasing new homes, fixing up their current homes with new projects, or purchasing new products to help keep themselves entertained.

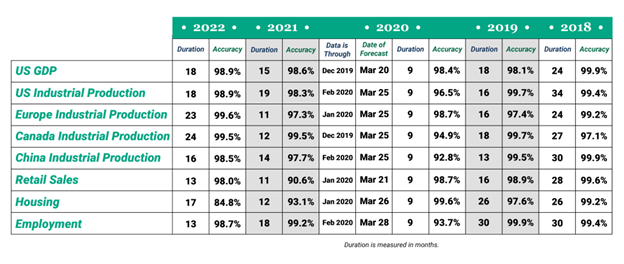

COVID brought a lot of chaos and uncertainty into the world, and yet ITR Economics retained its unrivaled forecast accuracy through it all.

ITR Economics 2024 Recession Forecast

Last year, ITR Economics CEO and Chief Economist Brian Beaulieu discussed how the inverse yield curve was upon us. Depending on the cycle, a yield curve inversion will typically lead a future economic downturn by 12–15 months. The timing of this latest inversion suggested that the US economy would enter a recession in late 2023 or in 2024.

Of course, we also looked at more than just the yield curve; our analysis included indicators such as the ITR Leading Indicator™, the US ISM PMI (Purchasing Managers Index), and various other indicators and datasets.

The thought of a recession makes many people uneasy. Business leaders and decision makers should keep in mind that ITR Economics is forecasting that the 2024 recession will be mild relative to previous recessions in recent years.

Which Recession Will Be More Severe?

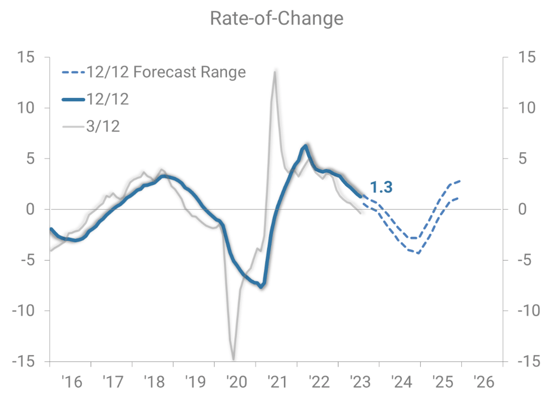

Looking at the US Industrial Production annual growth rate (i.e., the 12/12 rate-of-change) for the COVID-exacerbated recession, we can see that a low of -7.7% was reached in early 2021.

Shifting gears to our forecast for the 2024 recession, ITR Economics is expecting an annual growth rate low of -3.6%.

US Industrial Production Rate-of-Change

Published August 28, 2023

So, when we compare annual growth rates for the low points of the two recessions, the 2020 recession was more than twice as low as what we are anticipating for 2024.

To further put things in perspective, the Great Recession annual growth rate low came in at -12.2%.

As you can see, the 2024 recession will be milder than the 2020 COVID-19 recession. However, it will be important to avoid getting hung up on the negativity that will accompany this upcoming recession. Remember to factor the economic growth that will follow this downturn into your business planning so you can make the most of 2025 and beyond. To help ensure you make the best business decisions at the right times, contact us today at ITR Economics!