Europe Industrial Production is holding up quite well despite the economic stresses imposed by Russia’s energy policies toward Western Europe and the Ukraine war in general. There is a recent positive shift in the data and the associated rates-of-change. The 12MMA data trend has been setting record highs through October 2022 (blue line on the chart below). There are indications that the improved cyclical positioning will be sustained through the next one to two quarters. Positive indications from some of the leading indicators, motor vehicle production, and a recent improvement in inflation-adjusted retail sales in Germany are consistent with the positivity of the near-term outlook. However, the longer-term does not look as encouraging.

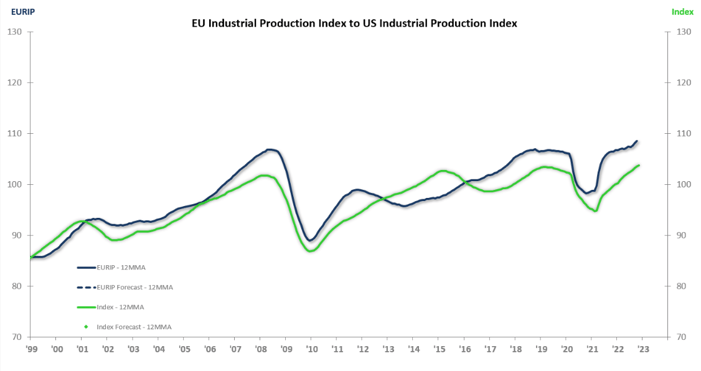

The chart below compares industrial production in the US and Europe. Europe will typically experience recessions in concert with the US. The US Industrial Production recession of 2015−16 did not significantly impact Europe’s trend. That recession was driven by plummeting oil prices negatively impacting oil and gas production and attendant industries. Those issues were largely localized to the US; oil and gas production is a much larger component of the US economy than it is of Europe’s.

We will likely experience essentially concurrent recessions in the US and Europe because the US is an important export market for the European Union. US imports from the EU are up 42.1% over the last 10 years. By comparison, US imports from China are up 33.4% over the same 10-year period ending in October 2022.

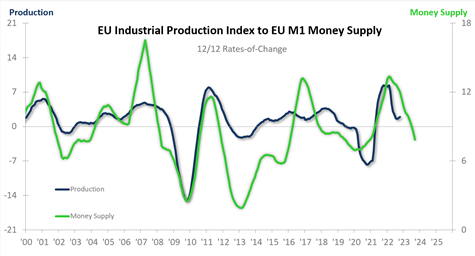

Additionally, Europe is feeling the same strains stemming from inflation, high interest rates, and tight monetary policies. The EU M1 Money Supply 12/12 rate-of-change is declining off a COVID-stimulation high in March 2021. The M1 trend to date indicates a generally weakening cyclical situation for Europe through the next 11 months.

Also signaling that Europe is going to experience a generally weakening business cycle environment along with the US is the cyclical descent in the JP Morgan Global PMI 1/12 rate-of-change. The PMI 1/12 typically leads Europe’s 12/12 by 11 months.

Combined with other leading indicators, potential energy constraints next winter, and the ongoing issue of high inflation in Europe, we conclude that Industrial Production in Europe will experience a relatively mild recession in 2024 along with the US.

The Management Objectives™ given the above are the same as those for the US market:

- Assess cash needs considering a potential decrease in cash flow.

- Maximize competitive advantages.

- Focus on markets that are typically countercyclical to the general business cycle (e.g., nonresidential construction, medical, pets, etc.)