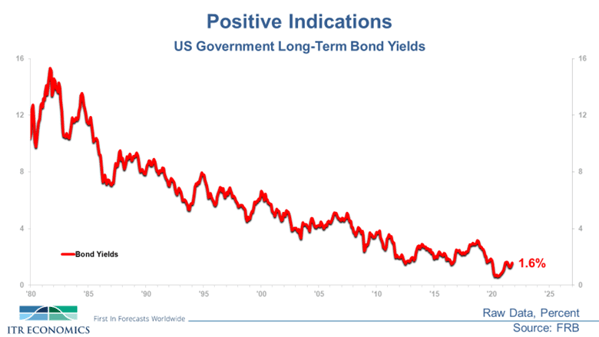

The Executive Summary for the November ITR Trends Report™ cited the bond market as one of the reasons why we expect the economy will grow, albeit at a slowing pace, in 2022. The charts below provide some detailed background for that assessment.

The US government 10-year bond yield is trading at approximately 1.6%. This may seem incredibly low given the level of deficit spending occurring in the US and given the sheer amount of money pushed into the economy by the Federal Reserve, Congress, and presidential administration (current and prior). Our view is that the bond market is making two statements:

-

- The current bout of inflation is transient and therefore interest rates “should” stay low.

- The bond market is not (yet) concerned about the full faith and credit status of the federal government.

Both statements are true for approximately the next 18 months, which is the typical leading indicator quality of the bond market based on our analysis. We have learned over decades of doing this work that one can argue with the logic, but the bond market will ultimately “win” because it is driven by market forces, involves so much money (more than the stock market), and is one of the factors the Federal Reserve historically gazes upon when deciding if it should be raising interest rates. At ITR Economics, we tend to not fight the market, but rather be informed by the market.

Someday we will see a different perspective coming from the bond market. The acknowledgement of higher systemic inflation will get baked into the yield, and we will start ascending to levels not seen in years. Additionally, if we see the 10-year yield (and others) running above what is normal relative to our major trading partners, we will know that the global bond market is losing faith in the federal government’s ability (or desire) to retire the debt. That day is not today. That is a good sign for ongoing growth in the US economy in 2022.

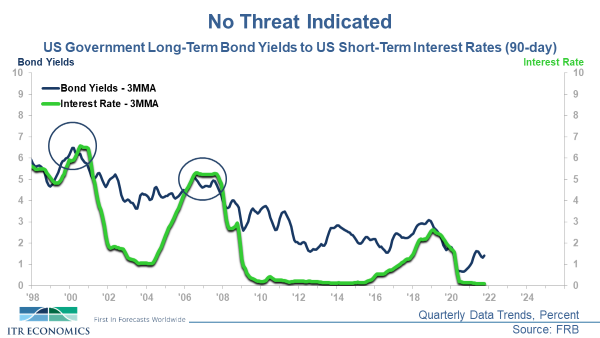

The next bit of analysis buttresses the above. The chart below illustrates that the yield curve is favorable, which suggests additional macroeconomic growth is ahead.

We know there is a looming problem for the economy if/when short-term interest rates (average of 30–90-day commercial paper in this instance) run above the longer-term 10-year bond yield. An inverse yield curve occurs when the short-term rate goes higher than the long-term yield. The chart shows that the last two times this happened we slipped into recession – in 2000–2001 and 2008–2009. It was touch-and-go regarding the yield curve before COVID, but we seem to be on safe ground once again.

What all this means is:

- Expect to be busy.

- Keep in mind slowing growth still means growth.

- Higher volumes of activity are ahead.

- The need for more labor, working capital, time, and energy is real.

- Growth is good news if you have a strategy to manage it.

The Trends Report can help you keep up with our expectations for economic trends in 2022 and beyond.

Brian Beaulieu

CEO