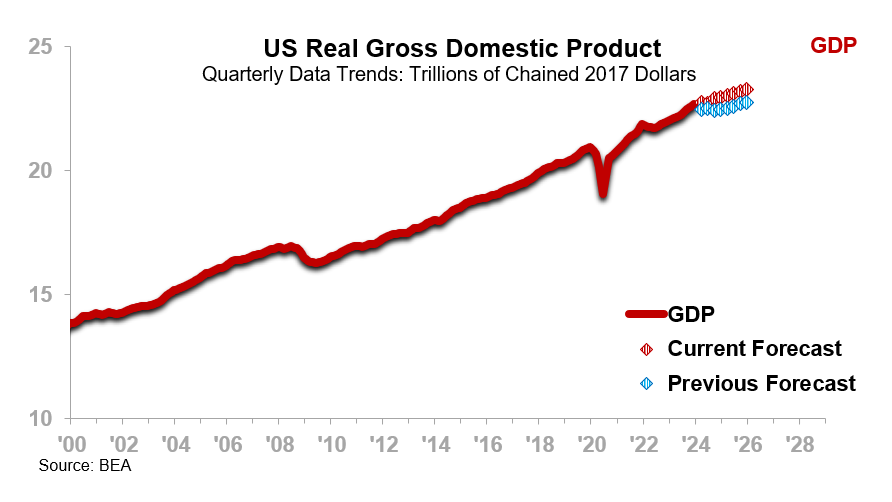

We have changed our forecast for GDP (in inflation-adjusted dollars). Before we get into the details, it is important to note that the change was not dramatic, and it does not change the Management Objectives™ that we discuss with our consulting clients and present in keynotes, blog posts, and TrendsTalk.

The Change in the GDP Forecast Pertains to the Non-Industrial Side of the Economy

If you are a service business, you are less likely to experience downside economic pressures on your business in 2024 than we had previously expected. This means you may see less slowing in your company’s rate of growth in 2024 than we were previously anticipating. A recession in GDP, which most people equate with “the economy,” was not part of the previous outlook.

A Recession in GDP Was Not Part of Our Previous Forecast and Is Not Part of the Updated Forecast

ITR Economics’ forecast for the industrial portion of the economy has not changed. Results through December have a 0.0% deviation from the forecast we put in place in mid-2023 (12MMA). We continue to forecast that Industrial Production will decline until late 2024, as indicated by a wide range of economic inputs. There is potential for the decline to extend into early 2025. Many, though by no means all, of the industry trends that comprise Industrial Production will move with the overarching Industrial Production trend. Industrial Production encompasses manufacturing, mining, and utilities. Many wholesalers, distributors, and others servicing the industrial segment of the economy are also likely to see a decline in revenue.

The Changes

- The current GDP forecast is for a year-end-2024 3MMA of $22.925 trillion in chained 2017 dollars, up 3.3% from the previous estimate of $22.186 trillion.

- The current forecast calls for one quarter of decline in 2024; the previous forecast had two non-consecutive quarters of decline.

- The outlook for 2024 is now flat to mildly positive as opposed to the earlier projection of flat to mildly negative.

What Has Not Changed

- The GDP trend in 2024 remains below the longer-term GDP growth trend.

- Businesses will need to manage the slower rate of rise in 2024 in comparison to 2023 in part by gaining market share. Competitive advantages and a first-class marketing plan are needed. A business-as-usual approach will not be sufficient.

- Efficiency gains continue to be necessary to keep EBITDA where you want it.

GDP performance in the second half of 2023 was stronger than we had anticipated. We underestimated the impact of the tremendous investment by the government in infrastructure and via the CHIPS and Science Act. Profit levels and cash balances in corporations held up very well despite the headwinds of slower growth in capital expenditures, high interest rates, and monetary policy. The January job numbers were also an important consideration, as they speak to more strength than previously anticipated in consumer spending, which is always a plus for the overall economy. Consumer health is looking good, which is an important driver to mild rise in GDP in 2024.

There are downside risks to the GDP forecast for 2024. Specifically:

- A sudden and significant rise in energy prices because of an expansion in the war in the Middle East.

- Interest rates remain elevated and monetary policy remains tight. Our outlook assumes some easing in rates and in monetary policy later this year. An inflation shock that drives interest rates higher has the risk of causing slower growth or a mild decline in GDP.

- The credit card delinquency rate is not currently a problem. However, a rise in the delinquency rate to the upper range of “normal” in late 2024/early 2025 could make it difficult for Retail Sales and thus potentially put downward pressure on GDP.

The key to the change is understanding where your company fits into the economy. The service sector in general will experience a slowing in the rate of growth, but the key is knowing what is likely to happen in your particular industry. It is financially painful to plan on slower growth and then find out that it was time to push the accelerator to the floor. The industrial sector outlook has not changed, and EVP™ clients and others who follow our forecasts for the industrial sector should stay the course.