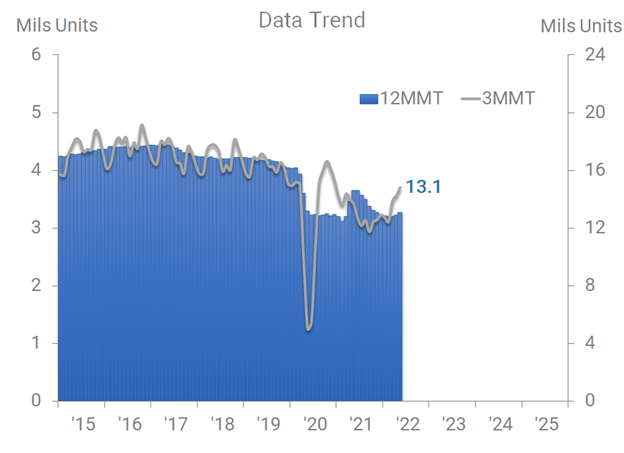

Our analysis of the latest data is that North America Light Vehicle Production established a low in March. Seasonal rise and cyclical improvement are underway. North American manufacturers turned out 13.1 million cars and light-duty trucks during the 12-month period from June 2021 through May 2022 (12MMT). That is a 2.3% increase from March’s tentative 12MMT low.

Indications that the nascent rising trend in the 12MMT data will continue include:

- Positive rate-of-change cyclical indications

- A stronger-than-average seasonal rising trend in the 3-month moving total (3MMT)

- A strong employment environment

- Rising real wages

- High consumer net worth

- Low consumer debt as a percentage of income

- Supply chain improvements

Further rise in the Production 12MMT (cyclical factors) and the 3MMT (seasonal factors) are probable.

What It Means for You:

Seeking opportunities or focusing on this rising market’s secondary and tertiary positive impact amidst slowing in other markets could provide you with the means to achieve your company’s own soft landing for this business cycle.

An equal and opposite reaction?

In his Executive Summary for the July 2022 Trends Report™,ITR CEO and Chief Economist Brian Beaulieu touched on the post-COVID-surge whiplash effect: Many of those companies and markets that happened to benefit – in some cases, handsomely – from the otherwise-economically-deleterious COVID impacts are now facing potentially painful corrective trends. The heretofore beneficial pandemic impacts are receding just as the macroeconomy softens, yielding a potentially compounded impact for those “lucky” few.

The light vehicle manufacturing industry is subject to the same overarching forces, but COVID’s impact there has been neither beneficial nor merely conventionally deleterious. Auto manufacturing, already hurting from a lack of chips, in many cases bore the brunt of the post-shutdowns supply crunch and COVID personnel restrictions. Given the financial status of consumers, it is possible there is some unsatiated demand in the marketplace.

Now, reports and data suggest those super-tight supply conditions are incrementally easing, especially as momentum recedes in pandemic-boosted markets, some of which are chip-intensive, and the broader macroeconomy. At the same time, auto industry participants have been taking matters into their own hands, procuring whatever’s available to do whatever’s possible. Between their scrappiness, the reactive economic forces, and the likelihood of unfilled demand, the auto manufacturing industry appears poised for business cycle rise even as macroeconomic growth slows.

Supply-side improvements

The supply situation is showing signs of tentative improvement, both in the active sense, as chip manufacturers move to fill automakers’ unrelenting demand, and in the reactive sense, as softening demand elsewhere creates the space for them to do so.

South Korea – the world’s third-largest chip producer behind China and Taiwan – reported that May’s inventories were up 53.4% from the May 2021 level.

The datapoint is consistent with industry-specific slowing growth trends at home – US Computers and Electronics New Orders for example are in Phase C (decelerating rise) – as well as global macroeconomic business cycle slowing. These trends may be a silver lining for the auto industry as, confronted with softening demand elsewhere, chip manufacturers turn to vehicle manufacturers to keep their sales robust.

Meanwhile, our forecast for US Semiconductor Production anticipates ongoing robust rates of growth even amid a business cycle slowdown. We expect double-digit rates of growth into early next year and a soft landing – with continued growth – at the bottom of the business cycle in mid-2023, before accelerating growth again takes hold and persists through at least year-end 2024.

Active supply chain management

US auto manufacturers such as General Motors began noting improvements in the semiconductor supply chain starting late last year. But they’ve reportedly been doing more than watching the chip supply build and giving thanks for the breaks as they arrive.

Throughout the post-shutdowns supply crunch, we have advised our clients to increase their visibility up and down their supply chains to evaluate not only their suppliers, but their suppliers’ suppliers. In the past, this would have been a stretch for auto manufacturers, who have been known to confine such interactions to Tier 1 suppliers. Now, makers are in many cases interacting directly with the chip suppliers, once way down the chain.

They’re making other changes, too. The just-in-time production model pioneered and popularized by Toyota in the decades following World War II has proved less viable amid widespread supply shortages; forced to choose between temporary plant shutdowns and the perceived inefficiency of stockpiling parts and assemblies, some auto manufacturers are finding the latter option less costly.

Finally, automakers have come to terms with the shortages. In their efforts to meet consumer demand, some manufacturers have resorted to delivering automobiles without key features. One maker discontinued heated seats on some models, promising buyers that dealerships would enable the feature once the necessary chips were available.

Is business cycle ascent imminent for the industry? Our forecast (available to Trends Report subscribers), suggests that it is given reported adaptations made by auto manufacturers, and a post-pandemic convergence of macroeconomic conditions, market trends, and reactive forces. As always, we will be closely watching the industry and its counterparts for any changes.